Real income of the population means that part state income, which is used by the population as storage or consumer objects.

The level of real income is determined on the basis of financial assets and material services accumulated and used per capita. The process of generating such income takes into account absolutely all types of income of society (both natural and monetary), various consumption funds (social payments, scholarships, etc.), and farm products. The amount of real income takes into account the deduction from it mandatory payments to the state budget, expenses for supporting cultural and social institutions and other financial and economic contributions.

The result of the process of generating real income is total amount income used by the population in a given period. In order to determine the qualitative dynamics of such profitability, experts divide the total amount by the price index provided to them, associated with the cost household goods and services. This approach makes it possible to achieve accurate comparability of real income over different time periods.

Real income is considered one of the most important indicators of the material standard of living of the population and significantly influences the growth of labor productivity. Currently, more and more new mechanisms for calculating real income are appearing, making it possible to effectively adjust the income received by the population and develop ways to increase it.

Sources of real income of the population

Currently, it is customary to identify several main sources of real income of the population:

- wages and other financial payments due to the employee if he takes part in one or another labor activity. Payments can be made either in cash or in kind;

– income from property ownership. This includes payments received for leased buildings, land, etc.

– income from individual activities (private, trade, etc.);

– preferential payments provided for by law, insurance payments, one-time benefits, etc.;

– income received from maintaining a personal farm – vegetable garden, orchard, etc.

Despite the fact that the number of sources of real income of the population is quite large, only some of them can rightfully be called truly important components of budget formation. Usually, most Social transfers also bring profit, the process of implementation of which is currently well established.

The size of the flow of real income of the population depends on how much tangible assets he has in stock. Real estate, land, transport - all these and many other values, if used correctly, can significantly improve the financial situation of a member of society and raise it social status. In addition, the amount of Money, which are at the disposal of one or another representative of the population.

The size of the flow of real income of the population depends on how much tangible assets he has in stock. Real estate, land, transport - all these and many other values, if used correctly, can significantly improve the financial situation of a member of society and raise it social status. In addition, the amount of Money, which are at the disposal of one or another representative of the population.

There is a qualitative two-way relationship between the real income of the population and its wealth, which manifests itself in the fact that the greater the real income, the more faster man gets richer, and, conversely, the richer a person is, the faster his profit from this or that type of labor activity grows.

However, the growth of real incomes of the population is determined not only by the factors of effective distribution of wealth, which are formed through the active and timely distribution of specific types of sources of profit. Great importance also has the level of socio-economic life in the state and the amount of cash receipts in one or another of its areas. In addition, it is necessary to take into account the process of individual distribution of income between individual families, controlled by various objective and subjective financial instruments. Unfortunately, today, all these tools are imperfect, so their use often leads to real income being distributed unevenly.

![]() The standard of living in the state directly depends on the level of real income of the population. The higher the material wealth of each member of society, the more financial income it receives, through which the financial and economic budget of the country is formed. Special meaning has the income of that part of the population that is engaged in various types of entrepreneurial activities, since it is private business is the main financial foundation on which the quality of life of the entire population is built.

The standard of living in the state directly depends on the level of real income of the population. The higher the material wealth of each member of society, the more financial income it receives, through which the financial and economic budget of the country is formed. Special meaning has the income of that part of the population that is engaged in various types of entrepreneurial activities, since it is private business is the main financial foundation on which the quality of life of the entire population is built.

Special attention should be paid to the influence of the level of real income of the population on the socio-psychological climate in the state. The more material wealth the people have, the higher their motivation will be, encouraging them to further improve both their lives and the life of the entire society. The only condition is that real incomes must be distributed more or less evenly among citizens, and this is, unfortunately, practically impossible to achieve today.

Modern experts believe that the level of real income of the population is currently not yet high enough to completely stabilize the situation in the country. However, there are already some high-quality developments, the use of which can lead to an improvement in the life of the state in the near future. The main thing is that the population continues to be financially active and continues to conscientiously fulfill all monetary obligations assigned to it.

INTRODUCTION

1 The concept and role of real income in the standard of living of the population, their indicators

CONCLUSION

BIBLIOGRAPHY

INTRODUCTION

At present, the concept of “national welfare,” as well as the degree of satisfaction of the material and spiritual needs of the working people,” has fallen out of use along with the system that they served. Moreover, these concepts, which have a positive meaning, cannot be used in conditions of impoverishment of the majority of the population.

In determining the standard of living in the literature there are observed different approaches depending on the initial positions of the authors. Such starting points are: production, consumption, income, cost of living, consumer regulations and standards, as well as their combinations.

Real income is the main, “vital indicator” and disclosure of the concept, presentation of the dynamics last years(since the 90s), makes it clear that general level population is slightly below average, that a person needs to strive to improve the standard of living on his own, but not without the participation of the state, without its support.

This topic examines the income approach, more precisely from the point of view of real income. The importance of real income for the life of a person as an individual is given, an analysis of statistical data for the period from 2000 to 2005 is carried out, as well as a forecast for 2007 possible values real income. In addition, a description of the main social strata is provided. Russian society, as well as measures necessary to increase the level of income of the population of Russia, required by the state of the Russian Federation.

To explore this topic, literary sources from 1999 to 2004 editions were used.

The purpose of the work is to study real income as the main indicator of living standards.

To the main objectives of this test work The following can be included:

Reveal the essence of the basic concepts of real income, their role in human life;

Define and draw a line between segments of the population;

Determine the role of the state in improving living standards;

Study measures to increase the level of income of the population of the Russian Federation.

1 The concept and role of real income in the standard of living of the population,

their performance

The approach to considering the standard of living from the consumer’s point of view as “from the income of the population” is widespread in domestic and foreign practice. According to statistics, the following socio-economic indicators of the standard of living of the population are given, characterizing the volume, composition, main directions of use and distribution between individual groups of monetary income of the population: disposable income of real households; expenses for final consumption; real disposable cash income; cash income and savings of the population, etc.

The income of the population, its level, structure, sources of receipt are the most important indicators economic and social well-being of society. Since income serves as the main source of satisfying people’s personal needs, they are the central link, the core of a broader concept – the standard of living of the population. It is important to know what is meant by income, what are its types and the main sources of receipt.

Real income is income that actually remains at the disposal of the population, which can be spent on final consumption.

Real income of the population - income corresponding to individual purchasing power, determined on the basis of real wages: the amount of material and spiritual goods (goods and paid services), which citizens can purchase with their cash income in the form of wages and payments from public consumption funds (pensions, scholarships, benefits, vacation pay), cash receipts from the sale of part of the products and services - the results of individual or cooperative labor activity, and other cash receipts (winnings from bonds and lotteries, etc.). In contrast to nominal income R.d.n. take into account the price level, the amount of taxes and other obligatory payments. Their volume also depends on the ratio of the effective demand of the population and the volume of goods and services offered to them, their structure and quality. An integral part The real income of the population is free and preferential services received by citizens from public consumption funds (free use of transport, reduced rent, partial payment for vouchers to sanatoriums, holiday homes, etc.).

The decline in production and the general economic decline, which continued throughout the entire period of reform, was accompanied for a considerable time by high inflation, which led to an unprecedented rise in prices and a fall in real wages and real incomes of the population. In recent years, the main reason for maintaining a low level of real cash incomes of the population, along with the permanent lag in wage indexation (primarily in the public sector), recalculation of pensions and social benefits from rising prices, is the chronic untimely payment of wages due to the lack of funds, and the same with numerous financial abuses and violations in this area.

Wages are a person’s real income, and if they are delayed or not paid in full, he gradually begins to infringe on himself in acquiring certain needs; he cannot afford some goods offered in the markets, thereby worsening his standard of living.

The financial and economic crisis of 1998 caused a rapid rise in prices for consumer goods. Index jump consumer prices(138.4% from August to September 1998 and 184% for the whole of 1998 relative to December 1997) led to the fact that real wages in December 1998 fell below the corresponding level in 1997 by one third, amounting to 65% from its level.

The financial crisis of 1998 reduced real incomes to the lowest level during the entire reform period. At the end of 1998, as a result of the financial crisis, there was a significant decrease in income overall by 21% compared to December 1997. Over the nine months of 1999, real wages compared to December 1998 fell by another 16%, and real cash income by 22%.

If, according to the Ministry of Economy, a decrease in real cash income in 1999 was envisaged by no more than 15%, then according to reporting statistics this figure was already 22% in September 1999. Thus, after the 1998 crisis, the process of further decline in the standard of living of the population continues.

So, the real disposable cash income of the Russian population - calculated minus mandatory payments and adjusted for the consumer price index - in August 2002 increased by 1.7% compared to July and by 6.7% compared to August 2004. The State Statistics Committee reported this. Average per capita income Russians in August 2004, according to Goskomstat, amounted to 3,784 rubles, which was 0.7% higher than the July 2005 figure and 24.3% higher than the August 2004 figure. The average monthly accrued nominal wage in Russia in August 2005 increased by 46 rubles, or about 1% compared to July, and amounted to 4,643 rubles, which is 37.7% higher than the level of August 2004. Real average monthly salary in August increased by 0.9% compared to July, while being 19.6% higher than this figure in August 2004.

We are often interested in changes in the cost of living due to changes in income and/or prices.

Let us assume that the consumer’s expenses are equal to his income and amount to

I 0 = ∑q 0 p 0

and in the current

I t = ∑q t p t

Here the superscript 0 corresponds to the indicators of the base, and the index t ≈ the current period; q and р ≈, respectively, the quantity of goods purchased and their price; product indices are omitted, since the sign ∑ implies the sum of expenses for the purchase of the entire set of goods (consumer basket).

To assess changes in the cost of living in the current period compared to the base period, nominal income and price indices should be determined.

The nominal income index is easy to determine; it will be

The price index can be defined in two ways: as the Laspeyres index

P L = ∑q 0 p t / ∑q 0 p 0

and as the Paasche index

P P = ∑q t p t / ∑q t p 0

named after the German statisticians E. Laspeyres (1834-1913) and G. Paasche (1851-1925).

The Laspeyres index involves weighing the prices of two periods according to the volume of consumption of goods in the base period, and the Paasche index ≈ according to the volume of their consumption in the current period.

However, neither one nor the other index gives a true picture of price changes, since they do not take into account the impact of this change on consumption patterns. Obviously, if (in the usual two-product model) the price of product X increases (P t X > P 0 X), then its purchases decrease (q t X< q 0 X) и, наоборот, при снижении цены (p t X < p 0 X) покупки увеличиваются (q t X >q 0 X). Therefore, the value of the Laspeyres index, which uses volumes q 0 as weights, gives an exaggerated idea of the change in prices if they rise, but an understated idea if they fall. On the contrary, the value of the Paasche index, where volumes q t are used as weights, gives an underestimated idea of the change in prices if they rise, but an exaggerated idea if they fall. And in any case, the Laspeyres index turns out to be higher than the Paasche index (P L > P P).

It can be shown that the consumer's position in the current period will be better than in the base period if the Laspeyres index is lower than the nominal income index:

I t /I 0 > = P L

It can also be shown that the consumer’s position in the current period will be worse than in the base period if the Paasche index is higher than the nominal income index:

I t /I 0< = P P

Let's first consider the Laspeyres index. If ∑q 0 p t ≤ I t, the initial set of goods (vector q 0) is obviously available to the consumer at current prices (vector p t) and income I t. This means that even under changed conditions, the consumer could still buy the original set q 0 . If in fact in the current period he buys a different set (vector q t), then either

∑q 0 p t< ∑q t p t ,

this would mean that the set q t belongs to a higher indifference curve, i.e. promises the consumer greater satisfaction than the set q 0, or

∑q 0 p t = ∑q t p t ,

this would mean that the sets q 0 and q t have equal value, i.e. belong to the same budget line, but the consumer clearly prefers the set q t that promises him greater satisfaction, i.e. belongs to a higher indifference curve.

Dividing both sides by ∑q 0 p 0 , we have

∑q 0 p t / ∑q 0 p 0 = ∑q t p t / ∑q 0 p 0

The left side of (3.25) represents the Laspeyres price index, the right side ≈ the nominal income index. Hence,

Thus, the statement is proven. It can be illustrated graphically.

2 Analysis of the level and dynamics of real income, wages, pensions, social benefits. Distribution of the population by income level, their relationship with the cost of living and the degree of satisfaction of needs

In addition to the fact that the value of wages does not satisfy the standard of living, there is a constant or periodic delay, depending on the organization.

The total overdue wages as of January 1, 2000 amounted to 43,741 million rubles.

Dynamics of real disposable cash income and real wages (in % on an accrual basis from the beginning of 2004 to the corresponding period of the previous year)

Rice. 1 The dynamics of real cash income of the population during the reform period is negative

At the turn of the new millennium, an extremely low standard of living for people emerged. On average, personal cash income in 2000 could buy less than two goods and services included in the subsistence level (LS). This is significantly lower than in pre-reform 1991. Then the purchasing power of cash income was 3.4 sets of subsistence minimum wages. Instead of the previously widely represented strata with average incomes, families with low level prosperity.

In the first half of 2000 the average size assigned monthly pensions was 624.8 rubles, which in real terms amounted to only 37% of the 1990 level. It should be noted that as a result of an increase in the average monthly pension in April 2000 - by 13% and in August 2000 - by on average by 18%, the average size of the assigned pension in September 2000 will be equal to 818.9 rubles, which will already be 45.0% (taking into account inflation from April to September 2000) of the 1990 level. The size of the nominal average monthly pension (from taking into account compensation) in April 2000 amounted to 153% of its value in April 1998, i.e. the relative increase in the nominal average monthly pension was only slightly more than half (51.9%) of the relative increase in the nominal average monthly wage of one employee. The consequence of this was the extremely low real content of the average monthly pension in April 2000 compared to April 1998. Despite the fact that over the last 12 months of this period the real amount of assigned average monthly pensions increased by 26.8% (the nominal average monthly pension increased by 52.1%), which exceeds the growth of real average monthly wages (real average monthly wages increased over the same period by 23.6%), the real size of assigned average monthly pensions in April 2000 was only 59.8% of their value in April 1998. At the same time, real accrued wages in April 2000 amounted to 79% of its level in April 1998.

For the majority of the population, the main expenses are aimed at the current consumption of food and non-food essential goods. He does not have enough money left to pay for services and savings, without which it is currently difficult to count on decent housing conditions, education and healthcare, or the replenishment of durable goods and property. In general, the low investment opportunities of Russians make it difficult for the state to develop the economy and social sphere.

Population incomes have increased in all social strata. The share of the poor in the fourth quarter of 2005 decreased by about 5 percentage points compared to the same period in 2004. This part of the population moved into the low-income and middle strata. Specific gravity the latter were approximately 29 and 22%, with an increase in the middle layer of approximately 3 percentage points. The share of relatively wealthy Russians was approximately 7% and increased by 0.4 percentage points compared to the same period last year.

The growth in household income was accompanied by a significant reduction in wage arrears. Thus, in the fourth quarter of 2004, the ratio of the price of the total average monthly wage arrears to the average monthly accrued wage fund was 60.5%, that is, the debt actually amounted to about two-thirds of the monthly wage fund. In the fourth quarter of last year, this ratio dropped by almost half and amounted to approximately 35.2%. Thus, the debt barely exceeded one third of the monthly wage fund. At the end of 2005, the debt was below the level of the 2nd and 3rd quarters, which characterizes a steady trend towards its complete elimination.

The analysis of the dynamics and structure of the population's cash income showed that per capita cash income in 2004 increased by 42.5%, and the population's expenses increased by 54.5%.

In the structure of cash income of the population in 2004, compared to the previous year, the share of income from property and income from entrepreneurial activity with a reduction in the share of wages and social benefits.

The highest wages are observed in the gas, fuel, oil refining industries, as well as in the non-ferrous metallurgy industry, the lowest in healthcare, education, and culture.

The standard of living of the population in 2004 improved compared to previous years, but at the same time the differentiation of income of the population increased (in 2004 the coefficient was 15.95 versus 6.23 in 2003), which is certainly a negative trend.

Today in Russia the effectiveness of state income policy must be increased. It should be aimed at a dramatic increase in the income of the bulk of the population (primarily due to an increase in the minimum and average wages), a reduction in income differentiation, an effective and socially fair distribution of newly created value and the dynamic formation of a middle class on this basis.

3 Measures to increase the level of income of the population of the Russian Federation

Raising the standard of living of Russians is the most important program objective of social policy Russian state. The government’s priorities include restoring incomes and maximizing the effective demand of the population. For this purpose, the main directions of the socio-economic policy of the Government of the Russian Federation have been developed. long term perspective.

Solving these and other problems will make it possible to stabilize the standard of living of Russians, as well as turn the vector towards its improvement. In the main directions of the Government’s socio-economic policy Russian Federation given for the long term quantification general growth in well-being – an increase in private consumption (meaning final consumption of households) by at least 80%.

Government income stabilization programs take place in various countries. But the order of their formation is different.

One part of the funds for such programs is generated through the state budget and used centrally. The other part of the funds is generated from profits at the enterprises and funds themselves, (B former countries“state socialism”, about 70% of the funds for such programs were formed at the expense of state budget and only 25-30% of the funds come from enterprise profits).

Through channels government programs assistance are satisfied

the need to educate young members of society, support the elderly and disabled, ensure (partly) education, and maintain health. The degree of satisfaction of these needs is determined by the level of economic development that has developed in the given conditions and the value attitudes that have developed in society.

The distribution of funds through assistance programs is carried out in three directions.

The first direction is characterized by the fact that part of the income received by the population depends on labor, but the size of satisfied needs is also taken into account.

The second direction is characterized by the fact that the payments made are not

have connections with the work of a given employee, and the size of the needs to satisfy which these payments are directed is taken into account. These payments cover child benefits for workers with many children, single mothers, for specialized treatment, state subsidies for the maintenance of children in child care institutions and boarding schools. The size of this subsidy depends on the number of children and the income level of the parents.

The peculiarity of the third direction is determined by the fact that the main part of them, in the form of benefits and services, goes to the population directly in kind through the relevant institutions of the non-productive sphere. This part of the distributed funds forms a kind of “additional” income: they do not pass through the family budget and cannot be disposed of at its discretion. Such incomes are distributed without taking into account the measure of individual labor and are entirely determined by the interests and capabilities of society at a given specific historical moment.

The consumer of part of the state assistance is not all workers in general, but only those who have a need for it and only to the extent of this need. For example, for free medical care To a greater extent, those who are more often and more seriously ill and cannot pay for medical services turn to the services of school institutions - those who have more children of school age.

In other words, payments under assistance programs are designed to mitigate differences in income levels caused not by differences in work, but by reasons outside the labor process itself, and also to help satisfy a number of needs that are most important from the point of view of the tasks of forming abilities to work and personal development , achieving higher general educational and cultural levels, affordable healthcare, and pensions. But since this form of distribution affects the interests of society as a whole and each of its members individually, then public policy should be especially active in this area.

As is known from the means mass media, President of Russia V.V. Putin gave instructions to the Government of the Russian Federation on an early and higher increase in the basic part of the labor pension than was provided for by the Federal Law “On the Budget” Pension Fund Russian Federation for 2005”.

On February 9, 2005, the State Duma adopted the corresponding the federal law on increasing the basic part of the labor pension from March 1, 2005 from 660 to 900 rubles, and the Federation Council promptly (February 9, 2005) approved this Federal Law.

At the same time, other components in the existing payment system will also be increased. For example, the additional payment for dependents, which is calculated depending on the basic pension and is 30% of its amount, will be increased to 300 rubles; for disabled people of the first group who have reached 80 years of age, the increase will be slightly larger - 480 rubles.

For disabled people due to war trauma the increase will be 240 rubles. For veterans of the Great Patriotic War who are disabled war veterans and have reached 80 years of age, the increase will be quite significant - 1,200 rubles. Taking into account the lump sum cash payment and pension, the total amount for disabled military personnel who have become disabled as a result of a military injury and are over 80 years old will be from 6.8 to 7.2 thousand rubles.

In addition, it should be reduced government spending, not directly related to the effectiveness of economic management and those areas of activity for which the source of financing should only be the budget.

CONCLUSION

An analysis of changes in the standard of living of the Russian population in recent years has shown that maintaining a low standard of living for the majority of the population is blocking it economic development, aggravates its socio-political instability. Social politics in Russia remains passive and inadequate to the current tense situation. All larger number citizens, socio-political forces are in favor of changing the course of socio-economic transformations in the country.

The well-being of Russian citizens must be achieved mainly at their own expense and through their own efforts. This is the only way to ensure growth in personal income and gain the opportunity to move to a higher rank of the social stratum of Russian society.

The implementation of the planned measures by the state of the Russian Federation will be successful in the event of interaction public associations, state entrepreneurs. This will restore people's trust in government organizations, directing resources towards national revival. After all, people involved active search possible forms of social support, they believe that if wages and pensions are not paid, then there is no point in hoping for social assistance, since “all the money comes from one pocket.”

Only by increasing real incomes can we ensure a decent existence for ourselves and our children, a good education and medical care.

BIBLIOGRAPHY

1. Birman I. “The level of Russian life (as well as American): questions - materials - comparisons - some answers." – M.: Scientific world, 2004.-512 p.

2. Bobkov V. Journal “Adequate wages - the goal and means of increasing living standards” // Man and Labor, No. 8.

3. Bobkov V.N. Ways to stabilize and improve the standard of living of the Russian population. – M.: Publishing house VCUZH, 2001. – 448 p.

4. Vyshegorodtsev M.M. Standard of living in Russia as a factor in the development of human capital. M.: Dialog MSU, 1999. - 228 p.

5. Zherebin V.M., Romanov A.N. Standards of living. – M.: UNITY - DANA, 2002. – 592 p.

6. Moskovskaya A.A. Dynamics of real incomes of the population of Russia // Problems of forecasting, 2005, No. 4.

7. Population and income: collection of articles / Ed. AA. Sagradova. – M.: MAKS Press, 2001. – 96 p.

Surely you have noticed that in different years, with a certain amount of money, you can afford to purchase different quantities goods and services. For example, in 2010 you could buy 5 kg of meat for 1,000 rubles, but in 2017 the money you pay is much less, although the amount of money has not changed. All professional economists are well aware of this paradox. And that is why they distinguish between real and nominal income. Below we will find out what types of income there are, and also find out what the dynamics of real income of the Russian population is.

Types of income

Income refers to the totality of cash payments, goods and services that a person receives over a certain period of time (usually one year is taken for the billing period). Income has the following structure:

- Cash income. The sources of cash receipts do not matter - it can be wages, various government benefits and payments, rent, increase in savings in the bank, income from the sale of products Agriculture, cash gifts and so on.

- Income in kind. Income in kind refers to the totality of goods that a person receives directly and does not buy with money. These can be agricultural products (vegetables, fruits and other products that a person himself or collectively produced as a result of his labor), various gifts, material aid and so on.

- Indirect income. Indirect income refers to income that a person receives for free using various social infrastructure institutions. This could be treatment in a hospital, getting an education, raising a child in kindergarten and so on.

Economists distinguish between nominal and real income.

Nominal income means the totality of cash receipts for a certain period. It is also important to remember that nominal income is calculated without taking into account taxes.

Why then is the term “real income” introduced? And how does real income differ from nominal income?

The fact is that at different periods of time a person can receive the same nominal income, but with this income he can afford different amounts of goods and services. In simple words, real income of the population is the totality of cash receipts, taking into account certain factors that affect the amount of goods and services that can be purchased with this income.

The level of real income is influenced by the following factors:

- Price index. Due to inflation, money depreciates every year, which leads to a decrease in the number of goods and services that a person can buy for a fixed amount of money.

- Tax level. Every month, the majority of Russian citizens make tax contributions to the regional and federal budget, however, the tax rate may vary. Therefore, due to an increase or decrease in taxes, the amount of money that a person actually receives in hand after paying all payments to the budget may change.

- Payment for mandatory services. Basically, utilities fall into this group.

You also need to understand that often these factors directly influence each other.

For example, when taxes increase, many entrepreneurs will raise prices for their goods and services in order not to go bankrupt. This will lead to an increase in prices, which will significantly affect the number of goods and services that a person can purchase for a fixed price. wages.

Another example is tax cuts. The fact is that nominal income means the totality of money without taxes. If the tax rate is reduced, a person will receive a larger amount in his hands. The difference will allow you to purchase additional goods and services, that is, in fact, real income will increase when taxes are reduced.

Remember that real income of the population is always less than nominal at a fixed level of profit, since in all modern states Money depreciates due to inflation.

Dynamics of real income

To understand the dynamics of real incomes of the Russian population, we need to consider the relationship between the size of inflation growth and the growth of real wages. Why is this question so important? The fact is that in the media you can often hear what Lately wages have increased, which means the standard of living has increased. And indeed, if you look at the statistical data, you will find that over the past 10 years, wages have grown in almost all sectors of the economy.

But does this mean that the standard of living has increased?

This question is controversial and economists do not have a definitive answer. However, the following can be assumed:

If nominal wages grow faster than inflation (with a fixed level of taxes and equal cost of utilities), then real level income increases.

Let's look at an example. Let’s say that the level of taxes in the country did not change over the year and there was no increase in prices for utility services, and real wages increased by 10%. Inflation for the year was 5%. Then real growth salaries amounted to 10% - 5% = 5%.

In this case, economic growth occurs in the country, the population becomes more money. Excess money is used either for new expenses (purchase of things or services). People can also put money in a bank, which in turn will issue this money as credit loans to other people for business development, which will create new jobs, increase the variety of goods on the market, and so on.

If nominal wages grow slower than inflation, or grow at the same level (with a fixed level of taxes and equal costs of utilities), then the real level of income of the population decreases or remains unchanged.

Let’s say that in one country over the course of a year there were no changes in taxes or increases in prices for utilities, and real wages increased by 5%, and in another country the same thing happened, but real wages increased by 3%. Let's also assume that inflation in both countries was 5%. Then the real growth of wages in the first country was 5% - 5% = 0%, and in the second the growth of real wages will be 2% - 5% = -3%.

In this case, in the first country the real incomes of the population have not changed compared to last year. And in the second country they decreased. At overall growth wages - the population becomes poorer.

When the tax rate changes, real income also changes. For example, when the tax rate increases, there is a double reduction in salaries for employees - firstly, now the employee transfers a large amount of money to the budget, and secondly, entrepreneurs, having lost part of the profit, usually cut the salaries of their employees.

How have the real incomes of Russians changed recently? Numerous statistical research show the following:

- The nineties saw a serious collapse in real incomes. The peak of the collapse occurred in 1998, when real wages fell by 49% compared to the Soviet period. However, one must always remember that in the nineties economic accounting was kept rather poorly, and there were also many underground industries. That's why a large number of wages were not taken into account, so it is quite possible that the collapse was still somewhat less.

- In the zero years, there is a gradual increase in real income growth. The 2000s also saw gradual macroeconomic stabilization. Real incomes grew at an average rate of 3-4% per year, although not all economists agree with this estimate. In 2008, the global economic crisis began, which led to a moderate drop in real incomes of the population.

- In the tenth years due to various factors(consequences of the global economic crisis, sanctions and some others) there was a decline in real incomes again. Experts cite different figures for the decline, but most economists are inclined to believe that the rate of decline in real incomes of Russians in 2016 amounted to 5% per year, and over the past 5 years, real incomes have decreased by a total of 15-20%.

Conclusion

Now let's summarize the above.

The totality of goods, services and money that a person receives over a certain period is called income. Income is generated both from cash receipts that a person stores or spends on certain goods and services, and from natural goods. Another source of income is various free services provided by the government.

The purely monetary part of income is called nominal income. Nominal income is calculated without taking into account tax contributions to the budget. Economic science states that for a fixed amount of money in different time you can purchase different quantities of the same goods and services. This is due to inflation and changes in the tax burden. To emphasize this feature, economists coined the term “real income.” Real incomes are nominal incomes taking into account the price index and tax deductions.

When comparing living standards, many journalists often compare only the size of salaries. However, such a comparison will not be very correct, since both wages and the level of prices for goods and services may change at different times. To avoid this drawback, it is necessary to pay attention to the growth of real wages, since they more accurately reflect the well-being of the population.

Real wages in the Russian Federation at different times differed quite greatly from each other. In the nineties, real wages fell quite significantly compared to the Soviet period, but in the 2000s they began to rise again. After the global economic crisis and sanctions, real wages began to decline again, although the decrease compared to the nineties was not so significant.

In the first quarter of 2017, real disposable income of the population decreased slightly compared to its level in the first quarter of 2016, and the number of poor people decreased by 1.4 million people. How could poverty decrease while real incomes fell?

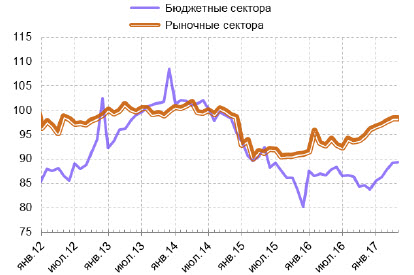

In the first quarter of 2017, nominal pensions increased by 17.1% y/y (due, first of all, to a one-time payment of 5 thousand rubles to pensioners in January to compensate for the low indexation of pensions in 2016) ( also, from February 1, 2017, insurance pensions for non-working pensioners and monthly cash payment, based on consumer price growth in 2016), and wages - by 6.6% (primarily in the non-budgetary sector of the economy (Fig. 1). However, due to the fact that other income ( the share of wages, including hidden wages, in cash income in the first quarter of 2017 was 63.3%, the share of all social payments, including pensions - 21.2%, income from business activities - 7.5%, income from property - 6%, other income 2%) either did not increase or decreased compared to the first quarter of 2016, the growth rate of total nominal per capita monetary income of the population was not so high (4.4%) and was covered by inflation (CPI increased by 4.6%). As a result, real disposable income of the population decreased by 0.2% y/y.

At the same time, the number of poor people, according to Rosstat estimates, also decreased in the first quarter of 2017: compared to the first quarter of 2016, there were 1.4 million fewer people. (decrease from 16 to 15% of the total population), although the level of socio-economic differentiation has remained virtually unchanged (Table).

1. Dynamics of average wages by employee groups (100 = 2014, seasonality eliminated)

Source: CEIC Data (Rosstat), calculations by the Development Center Institute of the National Research University Higher School of Economics

Distribution of total monetary income of the population by 20% income groups (%) and coefficients of socio-economic differentiation

|

I quarter 2016 |

I quarter 2017 |

|

|

Cash income |

||

|

including for 20 percent groups of the population: |

||

|

first (lowest income) |

||

|

fourth |

||

|

fifth (with the highest incomes) |

||

|

Gini coefficient (income concentration index) |

||

|

Funds ratio, times |

Source: Rosstat.

How can this be? In order to determine whether a person is poor, his income is compared with the subsistence level, and both are taken not in real, but in nominal terms. In the first quarter of 2017, the cost of living for the population of the Russian Federation as a whole was 9,909 rubles. per person per month. Compared to the first quarter of 2016, it grew by only 1.4%. It is this "freezing" living wage with a faster (albeit lower than the inflation rate) growth in nominal incomes, a decrease in poverty resulted in a decrease in poverty in the first quarter of 2017.

But why was the deflator for the cost of living so low? Of course, people classified as poor do not buy very expensive food products and do not foodstuffs; they, as statistics show, have fewer cars and some other durable goods; they consume fewer services, and these services are cheaper. But all this still does not explain what could have caused such a low rate of increase in the cost of living over the year. To answer this question, you will have to dive into the details of the methodology for calculating the living wage approved in 2013. According to this technique, its composition food basket includes a fixed set of food products according to special standards in physical terms, which are multiplied by prices obtained on the basis of a Rosstat survey of food prices - representatives used in calculating the cost of living ( Order dated March 11, 2013 of the Ministry of Labor and social protection Russian Federation No. 93n and Federal service state statistics No. 91 "On approval of the list of food products - representatives for determining the level of consumer prices for food products when calculating the cost of living").

The costs of non-food goods and services are estimated indirectly. The cost of non-food products is considered equal to 50% of the cost of food, adjusted for correction factor, equal to the ratio of consumer price indices for non-food products and food products. The cost of services is considered equal to 50% of the cost of food, adjusted by an adjustment factor equal to the ratio of consumer price indices for services and food. These three components add up to the cost estimate of the subsistence level ( Decree of the Government of the Russian Federation of January 29, 2013 N 56 "On approval of the rules for calculating the cost of living per capita and for the main socio-demographic groups of the population as a whole in the Russian Federation"). This technique has a number of disadvantages: for example, it poorly links changes in the cost of living with changes in the cost of services and, above all, tariffs for housing and communal services. As can be seen in Fig. 2, when prices for such services increase, the cost of living does not always respond to their changes (for example, in the third quarter of 2013-2015).

At the beginning of 2013, the introduction of a new method for calculating the subsistence minimum caused a sharp increase in its value (noticeable in Fig. 2), but then the situation began to stabilize. The devaluation of the ruble and the introduction of counter-sanctions on food products had a noticeable impact on valuation food basket and the entire subsistence level in the first quarter of 2015. Figure 2 shows a rapid increase in both the cost of subsistence level and all consumer price indices, especially taking into account prices for food products. Starting from the second quarter of 2015, the rate of increase in the cost of living varies from -3.7 to +3.4% compared to the previous quarter.

2. Dynamics of cost of living indices and consumer price indices, quarter to previous quarter, %