The value of which reflects the average prices for services and goods in the consumer basket for a certain time period. When calculating it, the ratio market value a pre-selected set of products for the current year to the basic one. In Russia, its analysis is headed by civil service Rosstat. The consumer price index according to this method includes the price of the consumer basket last month as the base period. In January, data from December of the previous year are used. However, the basis this indicator may differ depending on the country.

Calculation of the consumer price index

V general view The CPI is the quotient of dividing the sum of the products of current prices for the base year output by the previous total value of the basket laid down in the methodology. The calculated consumer price index will be an indicator of changes in the standard of living in the country. If Q 0 is the volume of products included in the consumer basket, and P 0 and P t are base and current prices, respectively, then the formula should look like this:

- CPI = ∑ (Q 0 x P t): ∑ (Q 0 x P 0) x 100%.

The result is recorded as a percentage. If it is more than 100, then the economy is experiencing inflation, as evidenced by the increasing cost of goods.

High inflation

The consumer price index demonstrates the change in the exchange rate of the national currency. An increase in its growth rate indicates an increase in inflation in the economy and the need to tighten monetary policy the regulatory body. At the same time, the Central Bank, when choosing its strategy of behavior in the market, should be guided not only by the actual indicator, but also its expected level. If workers believe in higher prices, they will start demanding higher wages. This will lead to the fact that manufacturers will increase the cost of products. On the other hand, high inflationary expectations lead to an increase in investment flows, since current consumption becomes more profitable than saving spare funds.

Low inflation problem

The monetary policy of the Central Bank is often aimed at reducing the rate of inflation, since it indicates the overheating of the economy, which impedes its sustainable growth. However, low consumer prices are also dangerous. Low inflationary expectations discourage households from investing their surplus funds, gradually halting economic growth. To prevent such a situation, the central banks are lowering interest rates.

Bar index

Many goods in the consumer basket are subject to price spikes, which makes inflation unstable from a simple calculation. Therefore, in many countries, the pivot index is additionally analyzed. It includes about a quarter of the goods and services in the basket, excluding everything that is subject to sharp price changes as a result of seasonal or weather factors. On the one hand, this makes it a more stable indicator. On the other hand, it leads to the fact that it less fully reflects the depth of the processes taking place in the economy.

Rosstat: consumer price index

The Federal State Statistics Service calculates all the main economic indicators... The consumer price index is analyzed in accordance with the Resolution of the State Statistics Committee No. 23 dated March 25, 2002. In March 2015, it amounted to 101.2% versus February and 107.4% versus December 2014 and 116.9% versus the corresponding month of 2014. Prices for goods increased by a larger percentage than for services. At the same time, the budget has a value of 111.4%, which makes the cost of the pension coefficient from February 1, 2015 equal to 71.41 rubles.

Criticism of the indicator

The consumer price growth index is based on a predetermined set of products. It is to the contents of the basket used that most of the questions arise. In order to reproduce the state of affairs in the national economy, it must reflect the real structure of consumption. But often countries do not change its composition for years, which leads to the exclusion of a number of services that are part of the Everyday life... In particular, in the basket in many developing countries does not turn on mobile connection, but only wired. On the other hand, if you change the set of goods and services, then this will make the new consumer price index incomparable with the previous one. If we compare the indicators obtained, then they can differ by a rather large amount.

Therefore, for the purposes economic analysis and planning, it is important to carefully approach the structure of the basket, changing it in the event of significant shifts in the structure of consumption. In general, the PPI fairly effectively reflects the market situation.

Consumer Price Index (CPI) characterizes the change over time in the general level of prices for goods and services purchased by the population for non-productive consumption. CPI is one of the most important indicators characterizing the standard of living of the population.

CPI applies:

to assess changes in the cost of living and inflation in the country;

to revise government social programs (the basis for raising the minimum wage, indexing living wage, indexation of the minimum pension, justification of subsidies and subsidies to prices that do not allow a decrease in the level of consumption by the population of essential goods and services);

in defining public policy in the field of finance, regulation of the real exchange rate of the national currency, analysis and forecast of price processes;

for recalculation of indicators of the system of national accounts from current to comparable prices.

The CPI measures the change in the value of a fixed set of goods and services in the current period compared to its value in the previous (reference) period.

The basket of basic consumer goods and services is fixed so that changes in the CPI only cause changes in prices, but not changes in consumption patterns due to changes in income or the purchase of other goods. Therefore, the CPI is also called the cost of living index.

The consumer set for calculating the CPI consists of three large groups:

Foodstuffs,

Non-food products,

paid services rendered to the population.

To calculate the CPI, the formula is used Laspeyres price index, but not an aggregate form, but the arithmetic average weighted from individual price indices, calculated according to the indicators of the structure of expenses. The weight is the share of consumer spending of the population for a certain representative product.

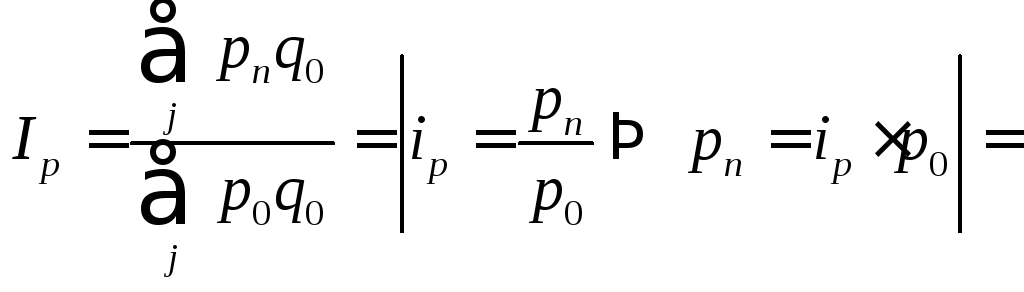

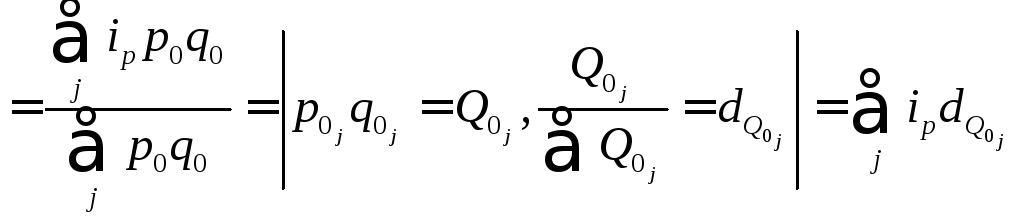

The Laspeyres pricing formula is transformed as follows:

,

,

where Q 0 - the cost of an individual product in the consumer "basket" of the base period;

- the share of household spending on a specific j-th product in the total volume of consumer spending in the base period;

- the share of household spending on a specific j-th product in the total volume of consumer spending in the base period;

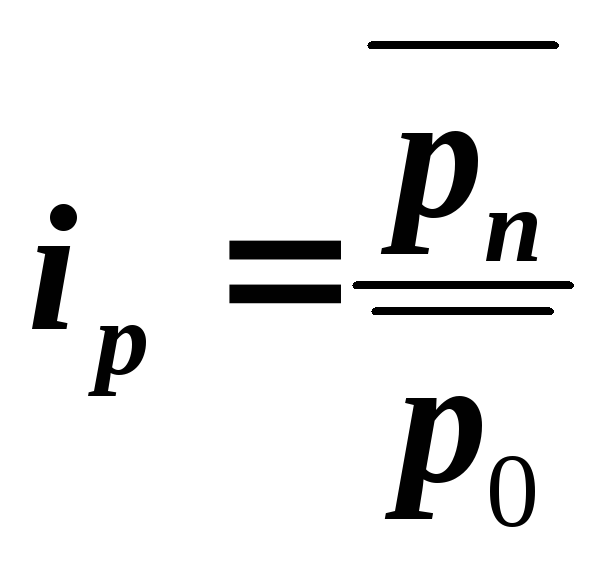

- individual basic price index for the j-th representative product,

- individual basic price index for the j-th representative product,

,

,

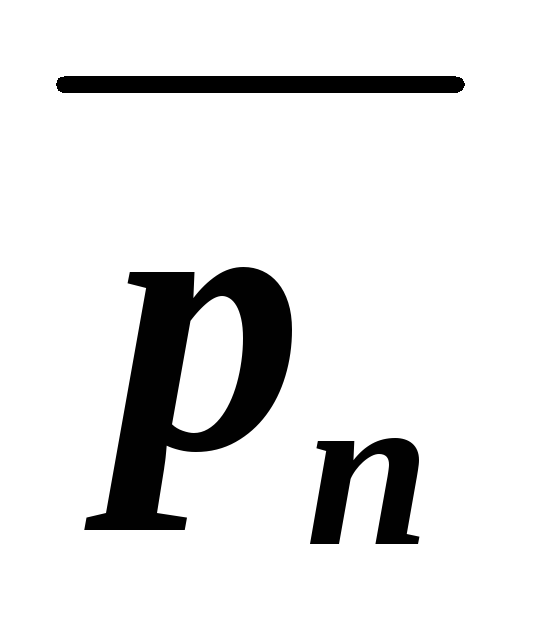

- the average prices of the goods, respectively, of the current and base periods. They are calculated as simple arithmetic averages of the prices recorded at the selected base outlets:

- the average prices of the goods, respectively, of the current and base periods. They are calculated as simple arithmetic averages of the prices recorded at the selected base outlets:

,

,

where M is the number of outlets.

Index shows, by how many times (or by what percentage) the consumer spending of the population would have changed in the current period compared to the previous one, if the level of consumption would have remained the same when prices changed.

The formula with individual base indices is difficult to use because over long periods of time, the range of goods sold changes, goods are replaced, the structure of commodity flows changes. Therefore, the individual basic price index is calculated as the product of chain individual price indices:

The use of chain price comparisons makes it easier to introduce new products or replace them when the need arises.

The consolidated CPI is calculated monthly, quarterly, and on an accrual basis for the period from the beginning of the year. The CPI is calculated monthly for the previous month of the current year and for the corresponding month of the previous year, as well as on an accrual basis from the beginning of the year to the corresponding period of the previous year. The calculation of price indices for a quarter, half-year, period from the beginning of the year is carried out by the chain method, i.e. by multiplying monthly consumer price indices.

Statistics show that using the Laspeyres formula tends to inflate real price changes. So, if the prices for some consumer goods increase in relation to the rest of the goods, then consumers reduce the cost of these goods. By replacing more expensive goods with some cheaper ones, consumers can buy a set of goods and services that is adequate to the previous one, but it will cost them less than buying the previous set at new prices.

The consumer price index calculated according to this formula does not take into account qualitative changes either. If the quality of goods and services improves, so should their prices rise. However, it is assumed that the entire increase in the monetary value of the consumer "basket" is entirely caused by inflation, and not by an improvement in the quality characteristics of goods and services. Consequently, the calculation on a fixed set is correct only for a short period of time, if during this time there are no significant quantitative and qualitative changes in the structure of consumer spending. Under these conditions, the CPI will adequately reflect the change in the cost of living.

The consumer price index according to the modified Laspeyres formula is calculated at the regional and federal levels.

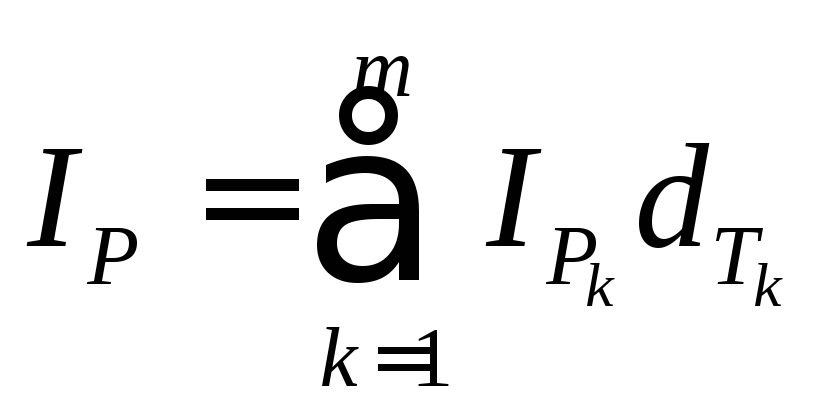

The composite price index for Russia is calculated as a weighted average from regional indices, the weight is the share of the population of the corresponding region in the total population:

,

,

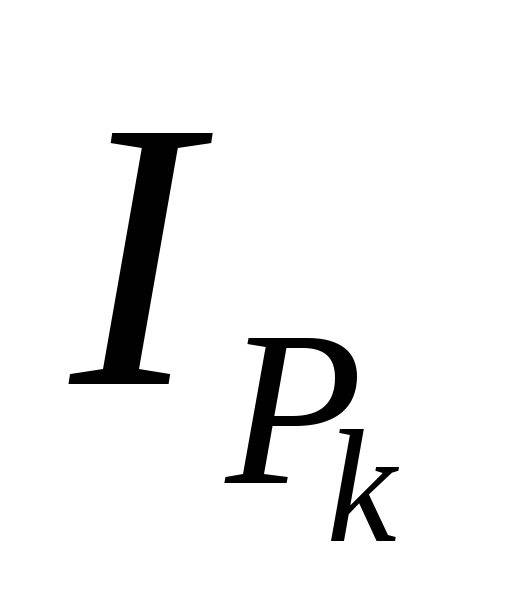

where  - consumer price index in the k-th region;

- consumer price index in the k-th region;

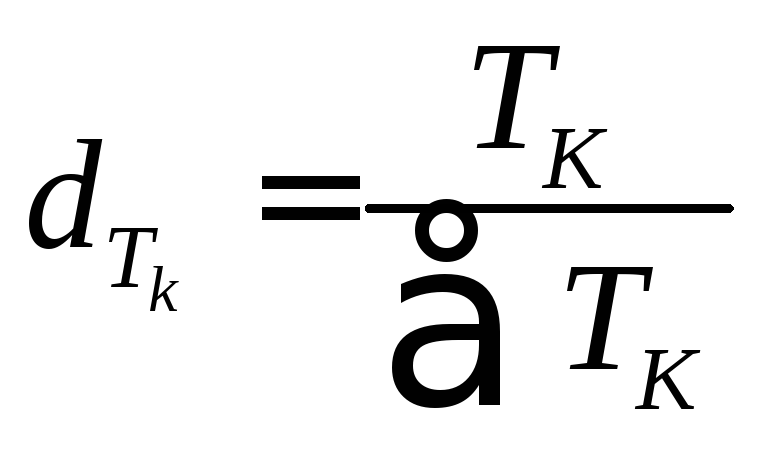

- the share of the k-th region in the total population of Russia.

- the share of the k-th region in the total population of Russia.

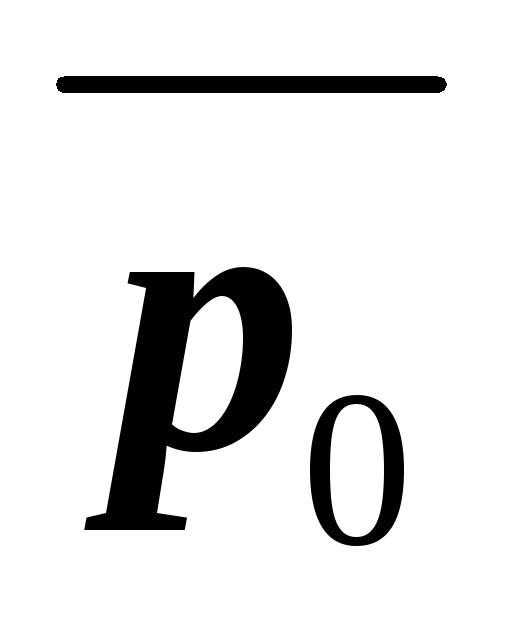

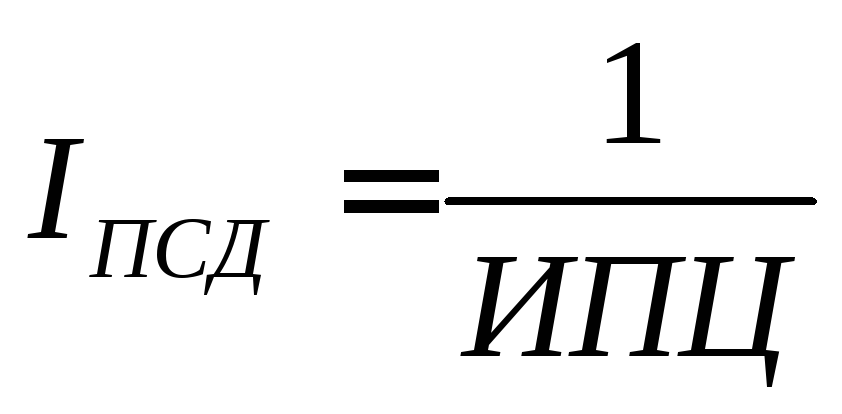

Money purchasing power index calculated as the inverse of the CPI:

Its value shows the relative change in the purchasing power of money held by the population.

Economic consumer price index is an index used to measure the average level of prices for services and goods for a certain period. It is based on the fixed value of a certain number of services and goods that make up the consumer basket.

In the Russian Federation, data on consumer price indices (abbreviated as CPI), regional and federal, for the whole year and for the month are posted on the Rosstat portal. Similar statistical research conducted since the early nineties.

The current formula for the consumer price index in a simple generalized version is as follows: the value of the consumer basket is divided by the value of the consumer basket in the reference period. And then the figure obtained in this way is multiplied by 100%(and the final result is also, accordingly, displayed with percentages). For the base period in the calculations of Rosstat, the previous month or year is taken. It should also be said that the calculations take into account the share of specific services and goods in the basket, for which the Laspeyres formula is used.

Let's give specific example to make it clearer what the consumer price index is. Rosstat indicates that in January 2017 compared to December 2016, the CPI was 100.5 percent, and in February 2017 compared to January, 105 percent. That is, expenses increased by 5 percent. In addition, Rosstat calculates the consumer price growth index separately for goods and separately for services. These numbers, of course, may vary.

It is also worth noting that in the economies of Western countries, the consumer price index or inflation index is called the Consumer Price Index (abbreviated as CPI). Moreover, in each country, the CPI is determined taking into account local specifics, everywhere there are some nuances. So, for example, in the United States, the consumer price index is calculated using a list of more than 260 names of services and goods selected in 85 cities of this country.

What makes up the consumer basket

Most controversial issue in the methodology for determining the CPI at the moment there remains the question of the list of what should be included in the consumer basket. Now it proportionally includes expenses for:

- food products;

- shoes;

- clothes;

- electricity costs;

- maintenance of their home;

- medical care;

- education;

- public transport;

- recreation.

Of course, in order to qualitatively reflect the fluctuations in the level of consumer spending, the basket itself must change over time and be in strict accordance with the real structure of consumption. Suppose that in 1993 it was inadequate to include in the basket spending on cellular communication, but today such an inclusion seems to be absolutely necessary. In Russia, for calculations, a consumer basket is taken, the parameters of which are approved by Federal Law No. 44, and, by the way, amendments were made to it in last time back in 2006.

"The minimum consumer basket of a man of working age, prepared by the USSR State Committee for Labor in 1989" and the federal law No. 44-FZ of 2006 "On the consumer basket as a whole in the Russian Federation"

CPI and GDP deflator

In addition to the CPI, there is another statistical tool that performs similar functions - GDP deflator... However, there are also significant differences between these two indicators.

- Only the so-called final consumer goods are included in the CPI, and any final services and goods included in GDP are important for calculating the deflator.

- In the process of calculating the CPI, statistics take into account imports, while only those services or goods that are produced directly within the Russian Federation play a role in determining the deflator.

The importance of the CPI for further strategic economic calculations

CPI data are of great use to many departments. Analyzing these data, it is easy to understand how poorer or richer the inhabitants of the entire country (or some one subject of the federation) have become over a certain period of time. That is, the consumer price indices for goods and services make it possible to adjust the income indicators of the country's residents for a period by general level prices and determine more precisely whether the incomes of Russian citizens have increased or decreased in real terms.

Comparative calculation table consumer baskets pensioners

The Ministry of Economic Development uses CPI data when preparing indexations salaries public sector employees, pension payments and various benefits. Also, the consumer price index is used to determine such a parameter as labor productivity.

There is also the so-called projected CPI (or projected inflation rate). Information about this level is taken into account when the budget is planned.

In addition, the Central Bank of the Russian Federation uses the inflation forecast to calculate the average annual exchange rate against the Russian ruble of other currencies. If inflation is high, then this suggests that the purchasing power of the ruble is falling. That is, the higher the forecast for the CPI, the weaker the rate of the national currency today.