Calculating real GNP simultaneously yields a useful measure of inflation known as the GNP deflator. Returning to the hypothetical example given in table. 2.1, we can get the inflation rate between 1982 and 1990 by comparing the 1990 GNP in 1Q90 and 1982 prices. The ratio of nominal to real GNP in 1990 is 1.22 (= 21 / 17.2). In other words, the output of 1990, being measured in more than high prices ah 1990 turns out to be 22% higher than when we measure it at the lower prices of 1982. We attribute this 22% increase to price increases or inflation during the 1982-1990 period.

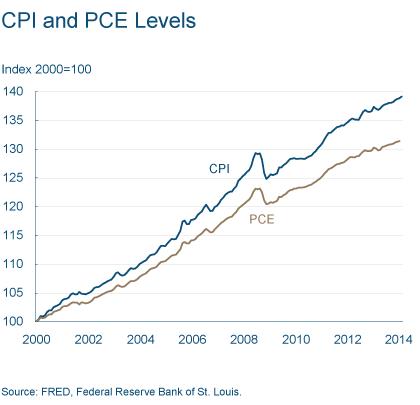

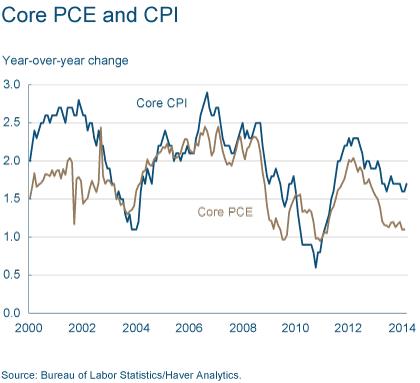

Two criteria are most important when it comes to evaluation: coverage and timeliness. Different, of course, but not too far away. The two measures, although in broadly similar trends, are certainly not identical.

In the short term, the main measure may give a more accurate picture of where inflation is going, but people buy food, fill their gas cylinders and heat their homes, so headline inflation more accurately reflects people's actual spending.

The GNP deflator is the ratio of the nominal GNP in a given year to the real GNP, and it is a measure of inflation for the period from the time at which the base prices are taken to estimate the real GNP to the present. Since the GNP deflator is based on calculations that take into account all the goods produced in the economy, it is a comprehensive price index that is often used to measure inflation.

Both indices calculate price levels by evaluating a basket of goods. If the price of the basket rises, the price index rises. The first difference is sometimes referred to as the weighting effect. When calculating an index number, which is sort of an average, some prices get heavier than others. People spend more on some items than others, which is why they are a large part of the basket and thus receive more weight in the index. For example, costs are more affected if the price of gasoline rises than if the price of lime trees rises.

Index consumer prices

The consumer price index (CPI) measures the cost * of purchasing a fixed set of goods and services ( consumer basket) typical of urban consumer purchases8. The GNP deflator has three main differences from the CPI. First, the deflator measures the prices of a much broader group of commodities than the CPI. Information about prices included in the CPI is collected by specially trained people who visit stores or find out by phone the prices of goods sold by different firms. Second, the CPI measures the value of a fixed set of goods that does not change from year to year. The consumer basket included in GNP varies depending on what exactly was produced in the economy in a particular year. When cereal yields are high, cereals receive relatively more specific gravity in the VNP deflator. The CPI, by contrast, measures the value of a fixed basket of goods that does not change over time.

The two indices have different scores for the respective basket. Another aspect of baskets that leads to differences is called coverage or scope. This is called the formula effect because the indices themselves are calculated using different formulas. There are a few other, mostly minor, differences related to elements such as handling seasonal adjustments. These are commonly referred to as other effects.

Source: Bureau economic analysis.

The Lexington metropolis continues to show signs of economic growth across a variety of performance indicators. Simply put, it is the ratio of the value of the goods and services that the economy produces in a given year at current prices, in relation to prices prevailing during any other reference year. Since the deflator covers the entire range of goods and services produced in an economy - as opposed to limited baskets for wholesale or consumer price indices - it is viewed as a more comprehensive measure of inflation.

Eisner presented his calculations in the Survey of Current Business (January 1985) and detailed them in the Extended System of National Income and Product Accounts (Journal of Economic Literature, December 1988). See also: Nordhaus, William and Tobin, James. Is Growth Obsolete? National Bureau of Economic Research. Fiftieth Anniversary Colloquium. New York: Columbia University Press, 1972.

The deflator is in the news because Chief Economic Advisor Arvind Subramanian mentioned it to show that inflation is currently at a very low level. How does this relate to inflation rates based on the more common wholesale price index and consumer price index?

Of the three, what is the safest measure? As mentioned, the deflator is the most accurate indicator of the underlying inflationary trend, as it covers all goods and services produced in the economy. The other two indices are derived from price quotes for selected product baskets.

8 From time to time, the composition of the consumer basket is changed so that it reflects the real structure of consumption.

Appendix 2.2. SHARES OF FACTORS IN NATIONAL INCOME

Table 1 shows how the national income is divided into different types of income, corresponding to the shares of factors. Most notable in this table is the very high share of wages and salaries in national income. It accounts for 73% of the national income. Entrepreneurial income is the income of an unincorporated business. The rental income of individuals includes the notional income for dwellings occupied by their owners *, as well as income from the ownership of patents, rights to develop subsoil, etc. The net interest category consists of interest payments by domestic enterprises and foreign debtors to persons and firms that issued loans.

Considering all this, the deflator is the best indicator of inflation in an economy. So why isn't the deflator used that much? Inflation that buyers experience or expect in the future is what counts in transactions with wages, and also determines the distribution of household savings across different assets.

But the criticism of this approach is that it works at normal times, whereas today we have an abnormal situation with deflation - at least on the part of producers. This is as volatile as the negative real interest rates that depositors received not so long ago on fixed deposits. In this case, the benefits to producers from a sharp decline in interest rates may well exceed the losses to savers. In addition, savings ultimately come from income, which in turn is a function of growth and jobs in the economy.

Dividing the national income into equal categories is not very important for our macroeconomic analysis. It is partly related to answers to questions such as: are corporations financed primarily by their own or borrowed funds, is the enterprise corporate or not, and who owns the housing - individuals or corporations, which in turn are owned by individuals **.

Consumer spending has been unexpectedly resilient amid steep tax increases and, in recent times, higher gasoline prices. Theories for this elasticity range from comparable positive welfare effects on rising stock and home prices to consumers' propensity to smooth out changes in disposable income. But a slightly noticed factor was lower inflation.

Receive our daily newsletter and editors. Selects ballots. However, based on the lesser-known personal consumer spending price index, core and core inflation is only 3%. This is more than a technical curiosity. The two indices often diverge because they are constructed differently.

Table 1

NATIONAL INCOME AND ITS DISTRIBUTION, 1988

і USD billion %

|

National income |

||

|

Employee benefits The reason appears to be a discrepancy between rental and healthcare behavior. Rental inflation has been relatively steady lately, reflecting strong demand from households that no longer qualify for mortgages or have lost their home to foreclosures. Meanwhile, as has been widely discussed, inflationary inflation in last years noticeably weakened. No one is sure why; The Obama administration controls the costs incurred under the Affordable Aid Act. A weak economy, which has forced employers and employees to curb consumption and force suppliers to better control costs, is certainly also a factor. To be sure, workers do not see the full benefits of lower health inflation as their employers and the federal government pay most expenses. But over time, this should translate to a higher wages because money that would otherwise have gone to benefits would go towards wages. |

||

|

Entrepreneurs' income |

||

|

Individual rental income |

||

|

Corporate profits |

||

|

Net interest Likewise, higher rents only affect a small proportion of the population who are now trying to rent an apartment. Most people who live in or buy their own home still enjoy low home prices in most markets and low mortgage rates. This creates an interesting dilemma for the Federal Reserve. This is why, for several months, he said inflation was running “slightly” below its 2% target. That understatement, Eric Rosengren, Boston Fed president, called it "much below" target in his speech Wednesday. |

NOTE. Data may differ from total amount due to rounding.

SOURCE: "Survey of Current Business".

* GNP includes estimates of the services that homeowners receive while living in own homes... These estimates are calculated based on data on rent for similar premises. Therefore, it is believed that the owner of the house pays himself for living in his house.

The main problem with inflation below the target is that it translates into higher real interest rates. But real rates are determined by expected inflation, not actual inflation. If anything, they may have risen slightly on the heels of the Fed's stated willingness to let inflation rise above 2% in pursuit of lower unemployment.

However, both metrics differ in how they are measured and, as a result, offer both advantages and disadvantages. It is essentially the relationship between nominal gross domestic product and real gross domestic product. Which results are an indicator of the price level of an economy that can be tracked over time. In addition, this ratio can be used to convert any price or index from nominal to real.

** You may ask yourself how the table should be modified. 1 according to the options listed here.

neither. Third, the CPI directly includes the prices of imports, while the deflator includes only the prices of goods produced in the United States9.

Until 1983, there was a fourth difference: in the 70s. and early 80s. The CPI misjudged the cost of housing costs and gave too much weight to interest rate changes. The index was revised in 1983 to improve the estimate of housing costs. The formal parameters of price indices are briefly described in Appendix 2.1. A more detailed discussion of the various price indices can be found in the Bureau's release labor statistics US "Handbook of Methods" and the US Department of Business Statistics published every two years.

It is an index of prices for goods and services that are usually bought by consumers. It is calculated using a basket of items that are weighed along with their respective prices. This basket is compiled from the Consumer Expenditure Survey. Thus, he distinguishes those who live and work in cities from those who work in cities but do not live there.

All of these components can vary in price. different reasons... Thus, daily assembly and evaluation can be done on a daily basis, while official statistics only do this on a monthly basis and is much cheaper. The flip side of the coin is, of course, that some items that are not sold online are dropped out of the survey.

Accordingly, the behavior of the two main indices used to measure inflation, the GNP deflator and the CPI, differ over time. For example, during periods when the price of imported oil rises rapidly, the CPI tends to rise faster than the deflator.

Producer price index

The Producer Price Index (PPI) is the third widely used price index. Like the CPI, it is a measure of the cost of a fixed set of products. It differs in part from the CPI in scope, since, for example, it takes into account the prices of raw materials and semi-finished products. It also differs in that it focuses on measuring prices early in the distribution process. Whereas the CPI measures prices where urban households actually shop, i.e. in retail, the PPI is calculated based on the prices of the first significant business transaction.

Nominal and real GDP. Price indices

Conspiracy theorists are likely to be disappointed - both indices are pretty close to each other. For example, you can use it to monitor aggregated sales figures for related items and determine their share of total household consumption expenditure. It contains two different products: "Food and non-alcoholic drinks" - about 10.3% and "Alcoholic drinks" - about 1.7%.

The reported share is about 2.6% of electricity. We now calculate the same stocks according to the aggregation method. Let's start with food. Food products in the same year amounted to 162 billion. It accounts for about 12% of total consumer spending. The average price per kWh was 18.5 cents, resulting in a total turnover of about 25 billion. Thus, the share of electricity costs in total consumer spending was about 1.8%.

These differences make the PPI a relatively more sensitive price index that signals changes. general level prices or CPI some time before they come. For this reason, the PPI, and in practice even some of its sub-indices, such as the "sensitive material prices" index, serve as one of the indicators of the business cycle and are the subject of close policy scrutiny.

Deviations in this value are to be expected and will not have a significant impact on the estimated inflation. Forris will not be convinced. An economic journalist or business blogger who writes online about something that has to do with prices or inflation nowadays almost inevitably expects to find his post on the forums shortly after comments, official inflation figures from the Federal Statistical Office instead claim that "true" inflation is many times higher. This view is usually adorned with a theoretical conspiracy to taste, because it's not just that, but it deliberately masks the true extent of the inflationary disaster that is or has already occurred.

Table 2.2 shows the dynamics of the CPI, PPI and GNP deflator over the past 38 years. Both the PPI and the GNP deflator use 1982 as their baseline. The CPI uses the period 1982-1984 as its base price. The GNP deflator expresses the value of prices in the current year compared with the prices of 1982, using the quantities of goods produced in each individual year as weights. The table shows that all three indices increased during the period under review. This reflects the fact that the average price of goods grew, no matter what set of goods we take. Note also that the cumulative increase ("1988 prices / 1950 prices") is different for different indices. These differences arise because the indices reflect the prices of different commodity sets.

Table 2.2

THE MOST IMPORTANT PRICE INDICES

|

CPI 1982-1984 - 100 |

PPI 1982 - 100 |

Deflator GNP 1982 - 100 |

|

|

Prices 1988 / Prices 1950 |

|||

|

Average annual inflation rate |

Inflation – it is a steady increase in the general level of prices for goods and services in the economy. The reverse process - a decline in the general price level - is called deflation.

Consumer price index as an indicator of inflation

Various indicators of price dynamics- producer price indices, deflator of gross domestic product, consumer price index. When people talk about inflation, they usually mean the consumer price index (CPI), which measures the change over time in the value of a set of food, non-food goods and services consumed by the average household (ie, the value of the “consumer basket”). The choice of the CPI as the main inflation indicator is related to its role as important indicator dynamics of the cost of living of the population. In addition, the CPI has a number of characteristics that make it convenient for widespread use - the simplicity and clarity of the construction methodology, the monthly frequency of calculation, and the promptness of publication.

The periods over which the CPI is measured may vary. The most common comparisons of the level of consumer prices in a certain month of the year with their level in the previous month, the corresponding month of the previous year, December of the previous year.

Statistical observation of prices, necessary calculations and the publication of data on the CPI in Russia is carried out by federal Service state statistics.

Features of the Russian consumer basket

In Russia, as in emerging markets as a whole, a characteristic feature of the consumer basket is a rather high share of food products in it (in 2014 - 36.5%). Their prices are quite volatile. To a large extent, fluctuations in inflation in the food market are determined by changes in supply volumes, primarily - the harvest of agricultural crops in our country and in the world, which significantly depends on weather conditions... Since the share of food products in the consumer basket is high, price fluctuations can have a significant impact on inflation as a whole.

Another feature of the Russian consumer basket used to calculate the CPI is the presence in it of goods and services, prices and tariffs for which are subject to administrative influence. Thus, the state regulates tariffs for a number of services. communal services, passenger transport, communications, some others. In addition, the prices for tobacco products, alcoholic beverages depend significantly on the rates of excise taxes.

Consumer demand is met by goods and services, both domestic and foreign production... There are no statistical data on the share of imports in the CPI, but an idea of it in terms of goods can be given by the share of imports in the structure of commodity resources. retail(in recent years - about 44%). A noticeable share of merchandise imports in the consumer basket determines the significance of the impact on inflation of changes in the ruble exchange rate.

Inflation factors

Prices can rise faster or slower. In the first case, they talk about an increase in inflation, in the second - about its decline. There are various reasons for the change in inflation. Let's consider them on the example of accelerating price growth. If the level of demand for goods and services exceeds the possibilities of supply to satisfy it, they speak of a pro-inflationary effect demand-side factors... In some cases, outstripping growth in demand may be affected by too affordable loans, accelerated growth nominal income economic entities. These sources of excess demand are often referred to as "Monetary factors of inflation"- pressure on prices due to the creation of excessive amounts of money.

Inflation can also grow when an imbalance in the market for a product or service arises due to insufficient suggestions, for example, due to crop failure, restrictions on the import of products from abroad, the actions of a monopolist.

Inflation can be driven by growth costs for the production and sale of a unit of production - due to the rise in the cost of raw materials, materials, components, increased costs of enterprises for wages, taxes, interest payments and other costs. Higher costs can also lead to a decrease in production and, further, to the formation of additional inflationary pressures due to insufficient supply.

The rise in prices for imported cost components may be due to both an increase in world prices and a depreciation of the national currency. In addition, the weakening of the national currency can directly affect the prices of final products imported from abroad. The overall impact of a change in the exchange rate on price dynamics is called "Carryover effect" and is often viewed as a separate factor in inflation.

Economic theory singles out as a special factor inflation expectations- assumptions about the level of future inflation, formed by economic entities. The expected inflation rate is taken into account by manufacturers when making decisions regarding the setting of prices for their own products, wage rates, and determining the volume of production and investment. Household inflationary expectations influence their decisions about how much of the funds at their disposal should be spent on saving and how much on consumption. The decisions of economic agents affect the supply and demand of goods and services and, ultimately, inflation.

Negative consequences of high inflation

High inflation means a decrease in the purchasing power of the incomes of all economic entities, which negatively affects demand, economic growth, living standards of the population, and mood in society. Income depreciation narrows opportunities and undermines incentives to save, which prevents the formation of a sound financial basis for investment. In addition, high inflation is accompanied by increased uncertainty, which makes it difficult for economic agents to make decisions. Together, this negatively affects savings, consumption, production, investment and, in general, conditions for sustainable economic development.

Benefits of price stability

Price stability means maintaining low growth rates of consumer prices, such as economic actors neglected when making decisions. In conditions of low and predictable inflation, the population is not afraid to save in national currency for long periods, since they are confident that inflation will not devalue their deposits. Long-term savings, in turn, are a source of investment financing. In conditions of price stability, banks are ready to provide resources to borrowers for long periods at relatively low rates. Thus, price stability creates conditions for investment growth and, ultimately, for sustainable economic development.