For manuscript rights

Turnover management

In agricultural enterprises

08.00.05 - Economics and national economy management (economy,

organization and management of enterprises, industries and complexes:

dissertations for a scientific degree

candidate of Economic Sciences

Novosibirsk 2008.

Scientific adviser: | |

Official opponents: | doctor of Economic Sciences, Professor |

Leading organization: | FGOU VPO Kemerovo State university |

Scientific Secretary

dissertation council

candidate of Economic Sciences, Associate Professor

1. general description of work

Relevance of the research topic.In recent years, many agricultural organizations have sharply sense a shortage of working capital for sustainable production development. Due to the growth of the share of food imported into the region, impaired equilibrium between prices for agricultural products and consumed material and technical resources, monopolism of enterprises related industries. If, before the start of agrarian reforms, agricultural enterprises at the expense of their own sources were replenished up to 73% of working capital, by 2006 these resources were completely lost.

Many agricultural organizations, due to the low level of income, cannot be manufactured on an extended basis, to update the material and technical base, paying timely with counterparties. Most farms have lost their own working capital, growth reserves have sharply reduced, the possibility of providing themselves with production reserves: seeds, feeds, fertilizers, repair young animals, are limited to the possibilities of purchasing material resources in the desired volume and assortment.

In the structure of working capital of agricultural enterprises, there are practically no funds necessary for current payments. Their share in reverse assets decreased over the period of agricultural reforms from 17 to 1.8%, and by the beginning of 2007, the cash had only 22% of agricultural producers on the settlement accounts. By the end of the year, a lack of funds in the amount of 75% of current assets was formed, which led to a delay in both payables and loans and loans.

Clean working capital is determined by two ways, using the left and right side of the balance:

OCC \u003d OS - CRP and OCC \u003d COST - VNA,

where OS is working capital, rub.; CRZ - short-term accounts payable, rub.; The contract is permanent capital, rub.; VNA - non-current assets, rub.

Permanent capital is the amount of equity equity and medium-term and long-term debt (payroll for more than a year).

The net need for working capital is associated with current operations taking into account stocks, general receivables, including non-bank accounts. The need for current financing can be divided into two parts: a cyclic, directly related to the economic cycle, and acyclic - independent of the cycle. Then the overall need for working capital will be:

CIS. from. \u003d CPU + ADC,

where CPU is a cyclical need for working capital, rub.; ADC is an acyclic need for working capital.

In this case, the cyclical need for working capital can be represented as follows:

CPU \u003d Z + DZH - KZH,

where z - stocks, rub.; Dzh - economic receivables, rub.; KZH - economic accounts payable, rub.

Economic debt includes receivables of buyers and customers and payables to suppliers. All other debt relates to other receivables and payables.

Acyclical need for working capital has the following structure:

ADC \u003d DzPR - KZPR,

where DzPR is other receivables; KZPR - other accounts payable.

Based on the above, we will calculate the need for working capital on the example (Table 2).

table 2

Calculation of the needs of Sukhovsky "in working capital, thousand rubles.

Indicators | ||||

2. Economic receivables | ||||

3. Economic Credit Debt | ||||

4. Cyclical need for working capital (p.1 + p.2 - p.3) | ||||

5. Other receivables | ||||

6. Other accounts payable | ||||

7. Acyclical need for working capital (P.5 - p. 6) | ||||

8. The overall need for working capital | ||||

9. Curvas | ||||

10. Short-term accounts payable | ||||

11. Clean working capital (P.9 - § 10) | ||||

12. Cash (claim 11 - P.8) | ||||

13. The degree of coverage of the need for working capital with money (p. 12: p.8 · 100),% |

The analysis showed that in dynamics the need for working capital is covered by an average of 8-9%.

The establishment of needs for working capital is the main complex of solutions to ensure the effective activities of the agricultural enterprise.

For a comprehensive analysis of working capital management, it is necessary to refer to the rating assessment and distribution of the studied agricultural enterprises in the quality of resource management classes. Each class corresponds to its point value, which is determined based on the indicators selected.

The rating assessment of agricultural enterprises is formed on the basis of the values \u200b\u200bof the economic coefficients and is an informative summary of the analysis of the effectiveness of working capital management.

Table 3.

Palile value of coefficients

Coefficient | Value, points |

Turnover of working capital | |

Current liquidity | |

Maneuverability of own funds | |

Security of current assets with their own working capital | |

Distrarability of payables | |

Ratosities of borrowed and own funds | |

Profitability of working capital |

Compliance with the criteria level of each of the coefficients obtained when analyzing the coefficients gives the corresponding value in points for rating evaluation. Additionally, 5 points are assigned to an agricultural enterprise, subject to the so-called "golden rules of the Organization's economy", in accordance with which the following values \u200b\u200bare considered: TV. p. - The growth rate of gross profits; Tr. - the growth rate of the implementation of the implementation; TOB. To. - The growth rate of the operating capital.

The most optimal ratio of these quantities is optimal:

TV. p.\u003e Tr. \u003e TOB. to.\u003e 100%.

Name of the coefficient (Regulatory value) | Changes for the period | Evaluation in points for the period 1 | Evaluation in points for the period 2 |

||

Coefficient of turnover coefficient (more than 2.0) | The value of the coefficient | The value of the coefficient | Number of points | Number of points |

|

Current liquidity ratio (more than 1.5) | The value of the coefficient | The value of the coefficient | Number of points | Number of points |

|

Coefficient of own funds (more than 0.5) | The value of the coefficient | The value of the coefficient | Number of points | Number of points |

|

Current coefficient of current assets with own working capital (more than 0.1) | The value of the coefficient | The value of the coefficient | Number of points | Number of points |

|

Credit debt turnover coefficient (more than 6.0) | The value of the coefficient | The value of the coefficient | Number of points | Number of points |

|

Ratio ratio of borrowed and own funds (from 0.3 to 1) | The value of the coefficient | The value of the coefficient | Number of points | Number of points |

|

Profitability coefficient of working capital (more than 0.2) | The value of the coefficient | The value of the coefficient | Number of points | Number of points |

|

The execution of the "Golden Rules" | |||||

The amount of points | The amount of points |

||||

Correcting score | |||||

The amount of points | The amount of points |

||||

Working capital management efficiency class | Class from 1 to 4 | Class from 1 to 4 |

Table 5.

|

evaluation, points |

Tarabrin Danil Vyacheslavovich

"Organizational and Economic Justification

Efficiency of working capital

(on the materials of the Tambov region) "

08.00.05 - Economics and national economy management

Organizations, complexes - APK and Agriculture)

Economic sciences

DM 040.041.02

Michurinsky State Agrarian University

393760, Tambov region, Michurinsk, ul. International, 101.

Tel. 5-31-37

For manuscript rights

Tarabrin Danil Vyacheslavovich

Organizational and economic rationale for the efficiency of working capital

In agricultural organizations

(on the materials of the Tambov region)

Specialty 08.00.05 - economics and national economy

(Economics, organization and management of enterprises,

Industries, complexes - APK and Agriculture)

Dissertations for a scientific degree

Candidate of Economic Sciences

Michurinsk-Sciences of the Russian Federation, 2009

The dissertation work was performed at the Department of Organization and Management of FGOU VPO Michurin State Agrarian University.

^ Scientist:

Shalyapina Iraida Pavlovna

Official opponents:

doctor of Economic Sciences, Professor,

^ Teuchev Vladimir Vasilyevich

candidate of Economic Sciences, Associate Professor,

Clemental Elvira Anatolyevna

Leading organization:

FGOU VPO "Penza State Agricultural Academy"

The defense of the thesis will be held "December 25" December 2009 at 10 o'clock at a meeting of the Joint Dissertation Council DM 040.041.02 in the Michurin State Agrarian University at the address: 393760, Tambov region, Michurinsk, ul. International, d. 101, dissertation hall.

The dissertation can be found in the library of the Michurin State Agrarian University, and with the author's abstract - additionally on the official website of the university: http://www.mgau.ru.

Scientific Secretary

United Dissertation Council,

candidate of Economic Sciences, Associate Professor O.V. Sokolov

^ General characteristics of work

Relevance of the research topic. Under conditions of market relations, working capital is acquired especially important, as they are an important criterion in determining the profit of the enterprise. The rhythm, coherence and high performance of the work of any agricultural enterprise are largely determined by its security with high-quality working facilities. And since the working capital includes both material and cash resources, not only the process of material production, but also the financial stability of the enterprise depends on their organization and efficiency of use.

Currently, in agriculture of the Tambov region, there are a number of unresolved organizational and economic problems of rational use of working capital, the effectiveness of the production activities of agricultural enterprises will largely depend on the solution.

The current practices for the use of working capital in Russian agricultural enterprises require significant improvement, refusal to obsolete forms and methods of their organization and management that restrain the increase in production profitability.

Thus, the organizational and economic substantiation of the efficiency of working capital in agricultural enterprises is one of the most important tasks in the way of increasing the effectiveness of agricultural production as a whole.

The urgency, insufficient development of the problem of the formation and use of working capital in agriculture put forward new tasks on this path and the need to further improve the efficiency of the use of working capital.

^ The state of problem learning. Questions of theory and practice of increasing the efficiency of working capital are investigated in the works of domestic and foreign economists: G. Belousenko, I.Ya.Demyanenko, O.V.Efimova, L.N.Kassirova, V.V. Kovaleva, L.I . Kolyacheva, E.S.S., V. Kushnira, L.A. Bernstain, Ambirman, S. B. Valter, K.K.Valtuha, D.K.Van Horn, N . С.Lisitsian, M.A.Pizengolts, V.D. Korotne-VA, G.N. Kochetova, V.Tetechev and others.

At the same time, in our opinion, the problems of efficient use of working capital in agriculture in the conditions of limited sources of their formation are not sufficiently studied and require additional research.

^ The purpose and objectives of the study. The purpose of scientific research is the organizational and economic substantiation of priority areas of increasing the economic efficiency of the use of working capital in agriculture.

Achieving the goal implies the solution of the following tasks:

Clarify the economic essence of working capital and consider the features of their circle in agriculture;

Identify the organizational and economic problems of the rational use of working capital in agricultural organizations;

Conduct analysis of the composition, structures and sources of formation of working capital of agricultural organizations and assess the level of security of them;

Analyze the efficiency of the use of working capital and systematize the factors affecting its formation;

Develop an effective policy of managing the working capital of agricultural organizations;

Justify priority areas to improve the efficiency of the use of revolving agents of agricultural organizations and offer the scheme of their replenishment.

The subject of the study are organizational and economic relations arising in the process of formation and use of working capital in agriculture.

The object of the study is agricultural organizations of the Tambov region of various forms of ownership and management. Monographic studies were carried out at the agricultural enterprise of the Michurinsky district of the Tambov region FSUE Education-Plemzavoda "Komsomolets".

The theoretical and methodological basis of the study was the works of classics of economic science, modern domestic and foreign scientists who have made a significant contribution to the development of theory and practice of formation and use of working capital.

The basis of scientific research is the dialectical method of knowledge. When solving the tasks, the following methods were used: economic and mathematical, expert assessments, economic and statistical, monographic, calculating, historical, abstract logical, graphic and other methods of collecting and processing information.

The information and statistical base of the study are reference materials of the Ministry of Agriculture of the Russian Federation, the Ministry of Finance of the Russian Federation, statistical collections published by state statistics by the State Statistics of Russia and the Tambov Region, Information Materials Department of Agriculture of the Tambov Region, Accounting Reports and Primary Documents of Agricultural Enterprises of the region, reference books, These scientific institutions, scientific publications on the materials of conferences and scientific and practical seminars and other information.

The dissertation work was performed in accordance with paragraph 15.52 "The final results of the functioning of the agro-industrial complex, the content, methods of measuring and the path of growth" Passports of the specialty 08.00.05 "Economics and management of the national economy (economics, organization and management of enterprises, industries, complexes - APK and agriculture ) ".

The scientific novelty of the study is to substantiate scientific and theoretical provisions and recommendations on the effective use of working capital in agricultural organizations in order to increase the economic efficiency of agricultural production. The main provisions of the dissertation study, which characterize the scientific novelty and are treated for protection include the following:

The concept of working rounds of agricultural organizations as an economic category is a value in monetary form, which, unlike existing definitions, includes not only cash, but also the surplus value advanced to the revolving industrial funds and the conversion funds to ensure continuous and sustainable their circulation, necessary for the functioning of agricultural organizations and the implementation of industrial or other activities;

The external and internal factors are systematized affecting the efficiency of working capital, with the allocation of the latest interrelated production (production technology, rational use and storage of working capital, etc.); economic (availability of free cash, economic ties and relations with suppliers and buyers, etc.); organizational and managerial (level of organization of production and management, organization of production reserves, management of receivables and payables, etc.) and social (provision of labor resources, labor productivity, the form of material incentives) factors;

A methodological approach to improving the management of production reserves of agricultural enterprises is determined, based on a combination of options for the frequency of reserves and its size, in order to increase the efficiency of use based on the use of the EOQ model for determining the optimal amount of the order, sharing ABC-method and XYZ-analysis of reserves classification in the nature of their consumption and significance for production;

A scheme of replenishment of working capital of agricultural organizations has been proposed that simplifies access to borrowed funds secured by land plots and allowing the state in the face of the agricultural warranty agency that acts as a guarantor of the loan return, control the land resource market;

An algorithm for the management of receivables of agricultural enterprises was developed, including: conducting the analysis of debtors and receivables, the implementation of its real value, monitoring the ratio of receivables and payables, planning cash flows on the basis of collecting coefficients, the development of advance payment policy and loans, the use of factoring and Control of the repayment of receivables, the use of which in the practice of making agriculture will increase the profitability of receivables, reduce the time of its collection and, thus, increase the efficiency of the use of circulation funds;

Priority areas of increasing the use of working capital of agricultural producers based on improving the production reserves management system, use by agricultural factoring organizations in managing receivables and the use of resource-saving technologies in the implementation of the zero tillage system, which ultimately lead to acceleration of working capital turnover, decrease Material consumption of products manufactured and growth in profitability of production.

The theoretical and practical significance of the work is that the use of agricultural work in the practice of agriculture developed scientifically based proposals is guaranteed to significantly increase the efficiency of working capital and steady increase in agricultural production. Methodical approaches and practical recommendations can be used by commodity producers in solving the tasks of improving the policy management policy and increase their effectiveness, as well as used in the educational process of higher educational institutions.

^ Approbation of research results. The main results of the work were reported and received approval at the International Scientific and Practical Conference "Innovation of Young Scientists and Specialists - the National Project" Development of APK "(Ryazan GSHA. P.A. Kosticheva, December 14-15, 2006); International Scientific and Practical Conference "Agriculture in the Modern Economics: a new role, growth factors, risks" (Viapi them. A.A. Nikonova and RGAU-MSHA. K.A. Timiryazev, XIV Nikonov Readings, October 27-28, 2009 g.; All-Russian scientific and practical conferences "Development of economic analysis and its role in the context of a transforming market economy" (Ryazan Gatu. P.A. Kosticheva, February 28-29, 2008); "Innovations of young scientists of the agro-industrial complex" (Penza GSHA, 2007), "Agricultural Science - Agriculture" (Kurskha GSHA. I.I. Ivanova, January 27-28, 2009), "Socio-economic features of the development of subsidiaries" (TSU them. G.. . Derzhavina, May 24-26, 2009), III All-Russian Scientific and Practical Conference "Agricultural Science in the 21st Century: Problems and Perspectives" (Saratov Gau, 2009), 61 Scientific and Practical Conference (Michgaau, March 26, 2009 .); twice in the II Tour of the All-Russian competition of scientific works of students, graduate students and young X scientists of agricultural universities of the Central Federal District (Orelgaau, April 26-27, 2007 and April 20-21, 2009), the final tour of the All-Russian competition for the best scientific work (RGAU MSHA. K.A.Timiryazev, 2007).

The main results of the dissertation study are set out in 12 printed work with a total volume of 2.1 pp. (including 1.85 pl. copyright).

^ Volume and structure of work. The thesis consists of introduction, three chapters, conclusions and suggestions, a list of references, which includes 154 names. The work is set out on 168 pages of typewritten text, contains 46 tables, 33 drawings and 8 applications.

^ In the introduction, the relevance of the study theme is justified, the state of the problem is considered, the objective of the objective and objectives, the subject, the object and research methods are determined, the scientific novelty and the practical significance of the research results are presented.

^ In the first chapter, the "scientific and theoretical aspects of the efficiency of working capital in agriculture" disclose the essence of the category of working capital and the peculiarities of their cycling in agriculture. The organizational and economic problems of the rational use of working capital in agriculture are systematized. Methodological approaches are considered to determine the provision, normalization and economic efficiency of the use of working capital.

In the second chapter "Analysis of the provision of agricultural organizations by working capital and the effectiveness of their use", the composition and structure of working capital of agricultural organizations of the Tambov region is considered. An analysis of the provision of various elements of working capital and sources of their formation is carried out. The effectiveness of the use of current production funds and conversion funds is considered. It is proposed to be allocated in the composition of internal factors affecting the efficiency of working capital, a system of production, economic, organizational and management and social factors.

^ The third chapter "Ways to improve the economic efficiency of the use of working capital in agriculture" defines a methodological approach to improving the management of the production reserves of agricultural enterprises. The algorithm for the management of receivables is developed and a set of measures to accelerate its turnover is proposed. Priorities are justified to improve the economic efficiency of the use of working rounds of agricultural producers based on improving the production reserves management system, the use of factoring agricultural organizations in the management of receivables and the use of resource-saving technologies in the implementation of the soil treatment system.

In conclusions and suggestions, the main results of research are summarized.

^ Main content of work

Curvas are important as part of the resources of agricultural enterprises, since the efficiency of production and financial sustainability of enterprises depends on their rational use.

From our point of view, the revolving agents of agricultural organizations are a value in cash, which, unlike existing definitions, includes not only the cash, but also the surplus value advanced to the revolving industrial funds and the conversion funds to ensure the continuous and sustainable circuits needed For the functioning of agricultural organizations and the implementation of industrial or other activities.

The studies have made it possible to identify a number of organizational and economic problems of rational use of working capital facing agricultural producers in the process of their activities (Fig. 1). At the same time, under rational it is necessary to understand the use of working capital in the minimum, but sufficient to effectively conduct the production of volume. In our opinion, the most acute problems of rational use of working capital are: the absence in many agricultural enterprises adequate to market conditions for planning production activities by the main elements of working capital, the irrational structure of working capital, the high level of taxes and bank loan rates, the lack of effective control policies Funds, low level of security with quality working capital, dispensation of prices for agricultural products and material and technical resources, improving the current and search for new sources of formation and replenishment of working capital, as well as an insufficient level of support from the state.

The analysis showed that the features of agricultural production affect the structure of working capital enterprises of the industry. It is precisely with this that the prevalence of production current funds in the overall structure of working capital of agricultural enterprises of the Tambov region: 56.9% -76.8%.

Studies found that the structure of working capital is significantly different in agricultural enterprises with different specialization (Table 1). For example, the smallest share of production current funds in the overall structure of working capital is observed in enterprises with two main industries: the grain production of sunflower. This can be explained by a small specific weighing animals on growing and feed in the structure of working capital.

Conducted studies in the field of agricultural production producers working capital show that, in general, the enterprises of the Tambov region do not have a sufficient amount of working capital necessary for the effective management of production and sales activities. This leads to the fact that long-term loans and loans are becoming increasingly important in the sources of the formation of current funds.

Fig. 1. Organizational and economic problems of rational use of working capital

In agriculture

Table 1 - Structure of working capital of agricultural enterprises

With a different combination of commodity industries, 2008,%

Indicators

^ Group of enterprises

on the combination of major commercial

industries (types of products)

Grain production

Grain beetroopy

Grain cattle breeding

Grain production

And sunflower

Lettering

Number of enterprises

^ Production Redemption Funds - Total

Productive reserves

Animals on growing and fattening

Unfinished production

Future spending

^ Calling Funds - Total

Finished products

Means in the calculations

Cash

^ Other working capital

Total working capital

Studies allowed to identify factors that determine the efficiency of the use of production current funds and funds for the appeal in agriculture, which can be divided into external: general economic situation, tax legislation, the conditions for obtaining loans and interest rates on them affecting the influence of the enterprise's interests, and internal, which an enterprise in one way or another is able to influence. In turn, among the latter, we propose to allocate groups of production, economic, organizational and management and social factors (Fig. 2).

The analysis showed that the most effectively working capital was used at a few enterprises with a period of turnover of funds to six months, and at the same time, more than half of the enterprises of the region, working capital have a level of profitability of up to 50%.

The deterministic factor analysis of the turnover of working capital allowed us to identify its dependence on the influence of two main factors - the amounts of turnover and average annual remains of working capital. At the same time, in two cases of five on the turnover coefficient, the average annual cost of working capital has increased greater influence,

there are two others - an increase in the amount of turnover, and only in one case the influence of one factor was leveled by another factor.

In our opinion, the development of a perfect mechanism for managing the working capital of agriculture and its effective application in practice is an extremely relevant problem at present, since the effective formation and regulation of working capital contributes to maintaining the optimal level of liquidity, ensures the efficiency of production and financial cycles of activity, and therefore , sufficiently high solvency and financial stability of agricultural enterprises.

When organizing the process of working capital management, much attention should be paid to the management of production reserves, since the efficiency of the production activities of agricultural organizations will largely depend on their rational use.

We have defined a methodological approach to improving the management of the production reserves of agricultural enterprises, which is a set of rules determining the choice of the most appropriate stock management system.

In our opinion, the most important areas of improving the process of managing production reserves are: selection of the most appropriate system of management, calculus for reserves for removing a number of restrictions when using the EOQ model for determining the optimal order of reserves and sharing with the ABC-method XYZ analysis of stock classification The nature of their consumption.

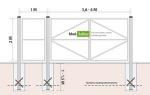

Through a combination of key parameters - the frequency and order size - six production reserves control systems were allocated (Fig. 3). The choice for use in the agricultural organization of a system must be based on the nature of the write-off materials in the production, supplier requirements and the nature of the stored goods.

It is recommended to use the classification of reserves by the nature of their consumption, using XYZ analysis, which will provide the ability to highlight reserves that are used constantly, seasonally, as well as resources that are irregular. The imposition of the XYZ analysis results to the data of the ABC method made it possible to break the reserves of nine blocks, each of which has two characteristics: the cost of stocks and the accuracy of predicting the need for them.

Studies found that in conditions of money deficiency in many agricultural enterprises, an important step towards improving the efficiency of the use of individual elements of industrial stocks can be savings on the relevant articles of material costs.

Analysis showed that the proportion of expenditures on seeds and planting material in the cost of the branch of agricultural organizations

Fig. 3. Formation of warehouse stock management systems of agricultural enterprises

By combining the options for the time periodicity and its size

The Tambov region ranges from 16.1 to 19.8%. You can save on seeds, but the possibilities of this article are limited, since only high-quality seed

No material provides a high harvest. Therefore, an important factor in saving seed is the name of their seeding. So, for example, due to the unreasonable stage of seeding seeds of two crops - oats and spring wheat FSUE, the Komsomolets Education and Spring Wheat In 2008, funds were overspending in the amount of 18.5 thousand rubles.

In inflation, when the immobilization of own working capital becomes very disadvantageous to enterprises, special significance in gaining issues of analysis, assessing receivables and accelerate its turnover.

Analysis showed that in recent years, in the agricultural organizations of the Tambov region, a tendency to increase the amount of receivables, including overdue, and its specific gravity in the overall structure of working capital. Under these conditions, the task of optimizing receivables and reducing its collection time becomes one of the priority areas of increasing the efficiency of working capital.

Research has been established that the receivables management process can be described by a specific algorithm, including: carrying out the analysis of debtors and receivables, the implementation of its real value, control over the ratio of receivables and payables, planning cash flows based on the collection factors, and the development of advance payment policies and granting Credits, factoring and repayment of receivables (Fig. 4), whose use in the practice of agriculture will increase the profitability of receivables, reduce the time of its collection and, thus, increase the efficiency of the use of circulation funds.

In agricultural production, it is possible to offer credit cooperatives of the Tambov region to include in the list of its services, the implementation of factoring services for agricultural enterprises of the region, and the latter - to use this type of services for more efficient management of its receivables.

Taking advantage of the factoring services of the credit cooperative, the FSUE Education-Persomolets, for example, will be able to reduce the amount of its receivables by 2.16 million rubles. And accelerate its turnover almost 10 times, which, in turn, will lead to a reduction in the period of circulation of working capital by 20.2 days and an increase in their profitability by 1.1 percentage points. (Table 2).

As a result of the correlation and regression analysis, a model of the dependence of the duration of the turnover of funds from a number of factors reflecting various aspects of the use of working capital was obtained.

Fig. 4. Algorithm of Control Department of Agricultural Leadership

Table 2 - Calculation of the cost of factoring service and the economic advantages of its use in managing receivables of the FSUE Education-Tribal "Komsomolets"

^ I. The cost of factoring service

Articles of expenditure on factoring

service

Calculation of value

factoring services

Service cost,

1. Commission for factoring management

32.2 million rubles. 0.5%

2. Accounting

(2.4 million rubles. 90%) 17%

Reference:

The volume of annual turnover \u003d 32.2 million rubles.

The sum of the reserved receivables \u003d 2.4 million rubles.

The cost of working capital at the end of the year \u003d 25 million rubles.

^ Ii. Turnover of receivables

Forecast / 2008

At 9.7 times<

^ III. Turnover and profitability of working capital

Forecast / 2008

For 20.2 days<

Per 1.1 pp \u003e

The multiple regression equation for the Tambov region examined by agricultural enterprises of the Tambov region was as follows:

Y \u003d 446,3069 - 122,9377x1 - 4,7561x2 + 0.0519x3 - 0.0408x4 + 0.0967x5 + 0.0496x6 - 20,3549x7,

Y - duration of turnover of funds, days;

446.3069 - Free term.

X1 - the cost of gross products per employee, thousand rubles. / Person;

X2 - the cost of working capital in the calculation of 100 hectares S.-H. land, thousand rubles / ha;

X3 - the magnitude of production circulating funds by 100 rubles. fixed assets, rub.;

One employee) per 1 thousand rubles. The turnover of funds is accelerated by almost 123 days.

X4 - the ratio of receivables and payables,%;

X5 - the ratio of cash and receivables,%;

X6 - the proportion of production current funds in working capital,%;

X7 is the value of working capital, accounting for 1 employee, thousand rubles / person.

The analysis showed that the duration of turnover turnover by 68.8% depends on the factors included in the model. In this case, the multiple correlation coefficient was 0.830, which indicates a sufficiently high degree of communication between the turning time and the factors included in the model.

For manuscript rights

Toyker Dmitry Vladimirovich

Development of the methodology for analyzing the working capital of an industrial enterprise

Specialty: 08.00.12 - Accounting, statistics

dissertations for a scientific degree

Candidate of Economic Sciences

Moscow -2009

The work was performed at the Department of Accounting and Analysis of the economic activities of the State Educational Institution of Higher Professional Education "All-Russian Correspondence Financial and Economic Institute"

Scientific Director: Doctor of Economic Sciences, Professor

Vakhrushina Maria Aramovna

Official opponents Doctor of Economic Sciences, Professor

Suglobov Alexander Evgenievich

candidate of Economic Sciences, Associate Professor

Ryzhova Valentina Vadimovna

Leading organization Financial Academy under the Government of the Russian Federation

The defense of the thesis will take place "___" ___________ 2009. in ___ hours in Aud. ____ at a meeting of the dissertation council on the protection of the dissertations of GOU VPO "All-Russian Correspondence Financial and Economic Institute" at the address:

123995, Moscow, ul. Oleko Dundich, 23.

The dissertation can be found in the library of the All-Russian Absentee Institute of Finance and Economics.

Scientific Secretary of the Dissertation Council,

k.E.N., Associate Professor V.A. Sitnikova

GENERAL DESCRIPTION OF WORK

Relevance of the research topic. In the context of the global economic crisis, which is primarily a liquidity deficit, issues of working capital management as the most liquid part of the company's assets have gained particular relevance. Unlike other spheres of economics, industrial production has a long financial and commercial cycle, therefore its implementation is associated with the greatest risk of economic losses due to the lack of or irrational use of working capital at a particular stage of the cycle. In this regard, each industrial enterprise needs to solve a two-way task: in the process of formation of working capital, exclude unnecessary costs for the purchase of current assets, and organize their use that will ensure the highest possible profits with minimal investments. The solution of this task, first of all, depends on the quality of intra-profit analysis, which is intended to determine the necessary amount of working capital, assess the influence of various factors for changing the effectiveness of their use, identify reserves of increasing this efficiency and serve as a substantiation of solutions to managers for the use of working capital.

The current methods for analyzing working capital are not free from flaws. The study of economic literature on the issue under consideration allows us to conclude that the improvement of the methodology of the analysis largely impede the problems of both a theoretical and practical nature. There is still no uniformity of views of scientists and practitioners on the nature of working capital. The coefficients used in the analysis process do not always allow reliably to determine the results of the use of working capital, therefore, methods based on the use of such coefficients are to take the right management decisions aimed at forming and improving the efficiency of their use. In addition, the information base based on financial statements, which is traditionally traditionally used for the purpose of analysis, contains significant restrictions on such an analysis.

These problems require a deep study in order to find ways to improve the quality of economic analysis of working capital.

In this way, target This dissertation work is to develop theoretical and methodological provisions and practical recommendations aimed at improving the intra-profit analysis of working capital of an industrial enterprise. In accordance with the specified purpose in the dissertations are set tasks:

- critically evaluate the accounting and analytical base, traditionally used in the process of analyzing working capital, and offer ways to further development;

- suggest new methods for analyzing working capital aimed at the further development of existing techniques;

- develop a mathematical apparatus used in calculations in accordance with the new method of analysis

- formulate recommendations on the expansion of the system of indicators used in the analysis of the efficiency of working capital.

Subject of research served as a combination of theoretical and scientific and methodological provisions of the economic analysis of working capital of economic entities, object research - economic activity of enterprises of machine-building, light and food industries.

Theoretical and methodological basis of the study. The theoretical and methodological basis of the study was the works of domestic and foreign scientists in economics and the analysis of the activities of organizations, legislative and regulatory acts of the Russian Federation on economic development and organization of accounting systems. Special attention was paid to the work of such domestic and foreign authors as A. Apcherch, V.G. Artyomenko, I.T. Balabanov, S.B. Bang holdz M.V. Belendir, S. Breg, MA Vakhrushina, L.T. Gilyarovskaya, A. Daile, O.V. Efimova, M.N. Creinina, V.V. Kovalev, S.A. Nikolaov-Nikolaeva, V.V. Ryzhova, G.V. Savitskaya, A.E. Suglobov, R.S. Saifullin, A.D. Sheremet, K.V. Squeezing, etc.

In the process of research, an economic and statistical method was used, grouping, integrated analysis, comparative and factor analysis, as well as other techniques of scientific research.

Scientific novelty of the dissertationlies in the following:

- suggestions are formulated to develop the accounting and analytical base, adequate to the objectives of the analysis of working capital and based on management accounting and reporting data (p.60-66);

- the method of determining the need for working capital is developed and theoretically substantiated, which is based on the calculation of the cost of the production and commercial cycle that simplifies the work on identifying this need (p.89-101);

- a new way to build an aggregated balance for analyzing the liquidity of an enterprise assets, based on the expansion of the current classification of the enterprise's working capital and changing the method of assessing assets. The proposed structure of aggregated balance groups eliminates the distortions of the source data inherent in financial statements (p.114-119);

- the necessity and developed the mathematical apparatus of calculating the turnover of working capital on the basis of the velocity of the physical passage of current assets of the production and commercial cycle stages is substantiated. This will eliminate the influence of factors distorting the calculations of turnover turnover at all stages of the cycle, as well as to calculate the turnover of each product group for carrying out a comparative analysis of the turnover of various types of products (p.128-138);

- reveal the feasibility of applying an EVA indicator not only in relation to capital as a whole, but also to determine the efficiency of working capital, which contributes to the expansion of analysis capabilities by using not only relative indicators (profitability), but also absolute (p.143-149).

Theoretical and practical significance of the research.The recommendations contained in thesis contribute to increasing the level of scientific validity of the conducted intra-revocative analysis of working capital. In addition, the approaches to the content of working capital analysis can be used in further scientific research and in the educational process in the preparation of the course of lectures on the discipline "Complex Economic Analysis of Economic Activities". The practical significance of the work is that the proposed approaches contribute to improving the quality of the analysis and, as a result, the adoption of informed management decisions aimed at improving the quality of the formation and use of working capital of the enterprise. Approaches developed during the study to analyze the formation and efficiency of working capital can be used in the work of enterprises of any industries.

Approbation of work.The author-formulated practical recommendations for the analysis of the formation and use of working capital were introduced into the practice of the food industry enterprises CJSC Province and Krasnaya Polyana + OJSC, which is confirmed by certificates of implementation. The main theoretical provisions of the dissertation were discussed at scientific seminars of graduate students, a scientific-practical conference of the All-Russian correspondence financial and economic institution "Modern problems of the organization of accounting, economic analysis and auditing" (Moscow).

The most significant provisions and results of the study were reflected in 7 articles and 1 monographs of the author with a total volume of 2.39 pp, incl. 2 publications in magazines recommended by VAC.

Structure and scope of the dissertation.The dissertation work consists of introduction, three chapters, conclusion, a list of used literature, including 161 source, and applications. The main dissertation text contains 174 pages, 34 tables, 11 drawings.

The dissertation has the following structure:

Introduction

Chapter 1. Evolution of the concept of working capital, problems of their analysis

1.1 Concept, composition and classification of working capital

1.2 Concept for the analysis of the formation and use of working capital

1.3 Modern approaches to the formation of the information base for working capital analysis.

Chapter 2. Intercommunicative accounting and analytical support for promising working capital analysis

2.1 Management reports as an information base for conducting working capital analysis

2.2 Detection of need for working capital based on management reporting data

2.3 Analysis of potential sources of funding for working capital

Chapter 3. Observing of working capital: management aspect

3.1 Building an aggregated management balance for analyzing the liquidity of assets of the organization

3.2 Analysis of turnover as a speed of passing by working capital of the stages of the financial and economic cycle

3.3 Ratioration efficiency indicators

Conclusion

Bibliographic list

Applications

The main provisions of the dissertation submitted to defense

Accounting and analytical support for working capital analysis

In market relations, issues of management of working capital of organizations acquire special significance. As an independent economic category, working capital has an effective impact on the production process and sales process. They own a decisive role in organizing the activities of the enterprise, in ensuring its financial sustainability and solvency, profits and profitability. The efficiency of working capital is largely determined by the effectiveness of the organization's activities. The complexity and variety of tasks associated with the use of working capital, an increase in their turnover and returns, cause profound studies in this area.

The analysis of working capital covers the following steps:

- identifying the need of an enterprise in working capital;

- determination of sources of funding for working capital;

- analysis of the impact of the state of current assets for liquidity;

- calculation of speed of turnover of working capital to determine the effectiveness of their use;

- analysis of profits obtained as a result of the use of working capital.

Generally accepted methods of analysis, as a rule, suggest the implementation of the above steps through the use of only these financial statements of the organization as an accounting and analytical base. However, financial statements are formed by the rules established by the state, and it does not fully take into account the information needs of the company's management. In this regard, in the thesis, it was proposed to be used to analyze working capital built on the management accounting data budgets and reports on their execution, which should reflect the same aspects of economic activities as the forms of financial statements, but the information content of the first is different from the content of the latter. The first is more analytic, contain not only financial, but also non-financial indicators and allow us to evaluate the assets of the enterprise not by the smallest of two indicators - cost and the market price - and for each of them. This will make not only more detailed information for the subsequent analysis of working capital, but also develop new, more correct methods for calculating analytical indicators.

In the process of research, the author carried out a comparative analysis of techniques based on financial and management accounting data, in relation to the activities of enterprises of various sectoral affiliation: CJSC Province (Food Industry), Kurskowfow LLC, Yegoryevsk-shoes OJSC (Light Industry) , CJSC "Kursk Machine-Building Production", OJSC Elevatormalemash and CJSC Kurskzinotekhnika (Mechanical Engineering) - which allows you to count on the versatility of our recommendations.

Determining the need for working capital

When determining the need for working capital, it should be noted that, firstly, the production costs of the enterprise and their lack can lead to interruptions in the production process. Secondly, the receipt of revenue often does not coincide with the time of shipment of products and the beginning of the new production cycle, that is, with the time consumption of material resources. Under these conditions, the enterprise must provide such a size of working capital, which will begin to start a new circuit, without waiting for the end of the previous one. In addition, an uninterrupted work, an enterprise must have a working capital sufficient not only for the formation of current assets and the implementation of industrial, commercial and management costs, but also to finance the activities of all servicing farms of the organization.

Therefore, it is necessary at the beginning of the first production cycle to sachamulate such an amount of working capital in order for, until the revolving funds are completed, and will not return in the form of revenue, the company could carry out costs associated with both production and sales activities and administrative and economic work. If you designate the amount of funds advanced to each stage of production and implementation as XI, then the total amount of the funds necessary in the planned period (x) can be calculated by the formula:

Where: N- The number of production and implementation stages in the planned period;

xi- Amount of funds advanced to the appropriate stage of production.

If this sum of costs add management costs (A0) and commercial expenses (C0), which are necessary for the functioning of the enterprise during the first production and commercial cycle, then the formula will take the following form:

The proposed approach saves labor costs in determining the need for working capital compared with generally accepted methods. In addition, it is focused on a production and commercial cycle, and not a total amount of the cost of the period, which avoids errors in the calculations of the planned amount of working capital when the scale changes.

Classification of sources of financing of working capital and the sequence of their analysis

In the conditions of a market economy, all financial resources with which the formation of working capital is carried out, they have their cost, therefore the analysis of the sources of working capital plays a significant role.

The thesis proposed in addition to its own and borrowed sources to allocate attracted sources of working capital. The attracted capital includes all types of accounts payable and isolated from borrowed capital, since borrowed capital is funds received by the enterprise in temporary use under conditions of urgency, repayment and payability, and for accounts payability is not characteristic. Consequently, the captured capital is fundamentally different from the borrowed source of the formation of working capital.

In the course of the analysis of the use of a source, two main criteria are urgency and capital price, therefore the art of the manager is to force it for a long time as possible, minimizing the cost of funds raised.

The following sequence of analysis of possible sources of financing is justified:

- evaluate which part of the need can be covered at the expense of own sources;

- calculate the time to attract borrowed or attracted funds to ensure the remaining need for working capital;

- determine the price of each borrowed or attracted source, which can be used during the analyzed period;

- based on the data obtained, make a source selection.

Building an aggregated management balance for analyzing the liquidity of the organization's assets

In the formation of working capital of the enterprise, it is necessary to pay attention to the liquidity of the developing structure of assets. The implementation of production and commercial activities is associated with the movement of material and cash flows. On the one hand, incoming the streams of the resources necessary for the performance of the production program cause cash outflows. On the other hand, the implementation of manufactured products leads to the influx of funds. Thus, as a result of the use of working capital in the production and commercial cycle, at the reporting date, an enterprise develops some structure of current assets formed to implement their activities and opposing their obligations.

The traditional method of analyzing liquidity consists in comparing assets and liabilities of the accounting balance, aggregated in four groups according to the following principle: assets - according to the degree of declaration of property liquidity, liabilities - according to the degree of elongation of the diversion of obligations. At the same time, for the conclusion that the balance is liquid, each of the first three groups of assets should be no less than the relevant groups of obligations.

Without detraining the meanings of the above approach, we note that it does not always allow to make informed management decisions, since the conditions that have developed today in which the company operates does not find its reflection in the external financial statements. For example, without the use of additional sources of information, it is impossible to determine the proportion of dubious receivables and the consequences of the non-risk of payables. The dissertation is justified by the need to share receivables and payables for debt formed in relations with independent counterparties (third-party debt) and educated in relationship with counterparties belonging to the same owner as an analyzed enterprise (structural debt), since in the short term, structural accounts debt It can be attributed to its own sources, and structural receivables - to the most liquid assets. Taking into account the foregoing, in the dissertation, a approach to the grouping of assets and liabilities of the Organization, which assumes the use of management reporting data (Table 1) is proposed.

Table 1

Grouping assets for liquidity analysis purposes based on management reporting data

| Assets | Passive | ||||

| 1 | 2 | 3 | 4 | 5 | 6 |

| Group Namely | Obscuration | Article asset | Group Namely | Obscuration | Article Passiva |

| The most liquid assets | A1. | Cash, short-term financial investments, structural receivables, promissory bills | Major urgent obligations | P1 | Credit debt minus structural, advances received, other short-term obligations |

| Rapidly real assets | A2. | Short-term receivables minus structural, dubious and promissory bills, regulatory remnants of finished products and other assets | Short-term liabilities | P2. | Short-term loans and loans, advances received, deferred tax liabilities |

Ending table. one

| 1 | 2 | 3 | 4 | 5 | 6 |

| Slow realizable assets | A3. | Reserves minus the regulatory remnants of finished products and illiquids, VAT on acquired values | Long-term liabilities | P3. | Long-term loans and loans |

| It is difficult to realize my assets | A4. | Non-current assets, long-term receivables minus structural, dubious receivables and illiquidcies | Passion | P4 | Own capital, structural accounts debt |

As can be seen from Table 1, the details of the management of the management balance will allow to group assets and liabilities of the organization for the subsequent analysis of working capital more adequately by the conditions for the economic activity of a particular enterprise.

The dissertation is argued that for the purpose of analyzing the stocks of raw materials, materials and finished products should be estimated at the price of their possible implementation, since it is precisely it, and not costly characterizes the magnitude of the potential revenue that allows you to pay with creditors. As a result of changing the value of commodity and material values \u200b\u200band fixed assets, the difference between the amount of assets and liabilities of the enterprise, which is proposed in the dissertation in their own capital.

The practical experience of the author makes it possible to argue that an analysis of the liquidity of an enterprise assets based on the use of management reporting data allows analysts to conduct more successful studies for the purpose of planning the acquisition of assets and making payments and make the most correct decisions on the financial flow management of the company.

Turnover of working capital as the rate of passage of production and commercial cycles

The most important factor in the influence of working capital on the results of the enterprise is turnover of working capital.

However, the fundamental factor in the importance of the traditionally used turnover indicators (the coefficient of turnover turnover, the duration of turnover and conditional release or attraction of funds) is the size of the revenue, which depends not only on the speed of the revolutions, but also from the profit-laid profit. In the generally accepted practice of calculating turnover, this fact does not find reflections, which does not allow a comprehensive analysis of the financial results of the organization's activities.

The turnover of working capital is due to the physical transition of assets from one state to another. Based on the formula "Money - Product - Production - Product" - Money "", a meter reflecting the number of assets involved in one turn, the amount of raw materials, which is simultaneously used in a narrow place of production of any group (species) of products. Then, using the budget execution report data, which reflects not only financial, but also non-financial indicators, you can calculate the management coefficient of turning (K'OB):

, (3)

, (3)

where: Q0 is a scheduled number of sales;

Q1 - the actual number of sales;

- the planned amount of the cost of raw materials (in quantitative terms), the main materials attributable to this product group;

ZZAGR - regulatory costs of raw materials in quantitative expression with full loading of a bottleneck (production stage or section characterized by insufficient or minimum amount of production capacity).

This indicator is advisable to calculate for each type (group) of products.

The expression 1 characterizes the regulatory amount of raw materials and basic materials entering the actual volume of production and implementation. It is easy to note that in the above calculation of turning, revenue values \u200b\u200bare identified according to the principle of revenue recognition (or proceeds on the fact of shipment) and revenue on the fact of payment. This indicator characterizes the speed of passing through the processes of production and storage of finished products in stock. To calculate the number of full cycles (until the moment of payment), the managerial coefficient of turnover K'OB must be adjusted to the ratio of revenue on the fact of payment and revenue on the fact of shipment.

(4)

(4)

where: K''ob - the management coefficient of turnover turnover before the receipt of money on the enterprise;

Nope - revenue by payment;

NOTGR - shipping proceeds.

The proposed method for calculating the turnover allows you to estimate the turnover of each type (group) of products.

At the same time, under the full load of a bottleneck, the work of not all the capacities available in this place occurrence, but only the parts that are used directly for the production of the type of product under consideration.

Substituting the values \u200b\u200bof K'OB and K'OB in a formula for calculating the average duration of one turn in days (ext), you can obtain the average turning time for turnover when determining revenue on the principle of revenue recognition d'ob and the average duration of turnover for turnover when determining revenue in fact Cash receipts on the enterprise d''ob

The sum of the released (additionally attracted) working capital (rub.) It is proposed to count on the formula:

The dissertation is concluded that, for calculating the amount of released (additionally attracted) working capital, an indicator of D'Or must be used, since receivables are part of working capital. In the case when d'ob1< Д’об0, для расчета высвобожденных средств должен использоваться показатель «выручка». Если же Д’об1 > D'Ob0, then for the calculation of the funds additionally attracted to the turn, the indicator "variables" should be used, since they will increase with increasing the duration of the production and commercial cycle. Permanent costs will remain unchanged for the period.

An important advantage of the proposed method for calculating the turnover is that it allows you to determine what part of the company's revenue received by the acceleration of turnover, which is due to the price change. Similarly, the change in the amount of direct costs may be caused by a change in the number of revolutions, a change in prices for consumed raw materials or rates for labor, as well as savings (overrun) of raw materials or an increase (decrease) of the operation time of the main production workers.

Deviation in revenue due to acceleration of turnover can be calculated by the formula (rub.):

, (6)

, (6)

where: - change of revenue due to changes in the speed of revolutions;

- management coefficient of turnover of the reporting period (by payment);

- Management coefficient of turnover of the basic (previous) period (by payment);

- revenue from sales of the basic (previous) period (by payment);

- the number of products sold products sold (by payment);

- The amount of products obtained with the full load of a bottleneck for one production cycle.

Deviation of direct costs (the cost of raw materials or the amount of accrued wages) is proposed to count on the formula (rub.):

, (7)

, (7)

where: - change in direct costs due to changes in the speed of revolutions, rubles;

- management coefficient of turnover of the reporting period (by shipment);

- the management coefficient of turnover of the basic (previous) period (by shipment);

- the cost of raw materials (labor costs) of the basic (previous) period for realized products (by shipment), RUB;

- the scope of the products sold products sold (by shipment) in a natural dimension;

- Product volume made with full loading of a bottleneck for one production cycle in a natural dimension.

Knowing the duration of the production and commercial cycle, it is possible to calculate the duration of its stages: production, storage of finished products before selling and receivables before payment of finished products by buyers. In this case, in practice, these indicators are more convenient to calculate in chronological, but in reverse order.

The duration of the receivables of receivables can be determined by comparing the duration of revolutions before shipment of the products to the buyer (d'ob) and until the buyer shipped products (D) shipped to it. Accordingly, the duration of finding working capital in the state of receivables (in days) is the difference between these indicators.

DDZ \u003d D "ON - D'OB, (8)

where DDZ is the duration of being working capital in a state of receivables.

The duration of the period of finding finished products in a warehouse can be calculated using the data of warehouse accounting cards: the time of arrival of products to the warehouse, as well as the time of disposal from the warehouse. Consequently, the duration of finding working capital in the form of stocks of finished products (in days) can be calculated on the average harmonic:

(9)

(9)

where - the average duration of finding working capital in the form of stocks of finished products;

DGPI - Duration of finding in the warehouse of each type of finished products;

Vi - the number of finished products of the corresponding form (group) in physical terms, located in a warehouse in a natural dimension;

n is the number of parties "past" through the warehouse during the analyzed period.

Knowing the duration of the period of spending working capital in the form of stocks of finished products and receivables, as well as the total duration of the production and commercial cycle, one can calculate the duration of the cost of working capital in the field of production (DPR). This indicator can be calculated as the difference between the length of the production cycle and the length of the cost of working capital in the form of stocks of finished products and receivables (in days):

DPR \u003d D "ON - DDZ - DGP, (10)

As the study showed, the managerial turnover coefficient, calculated through the costs of raw materials, as a rule, exceeds the turnover coefficient calculated by the traditional way. In the thesis, the causes of such discrepancies were disclosed: in practice, in the course of the implementation of the production and commercial cycle, the company carries a number of costs, directly with it not related, for example, management costs that are not advantaged into a circuit, but are compensated by the revenue received, recognizing the periods of the period. However, as a rule, in accounting, these expenses are attributed to the cost of finished products and the remains of unfinished production, thereby increasing the amount of working capital participating in the calculation of the turnover ratio and reducing its value.

The methodological approaches proposed in thesis make it possible to exclude the influence of factors distorting the calculations of the turnover of working capital at all stages of the production and commercial cycle, as well as determine the turnover of each product group, which is of particular importance when carrying out a comparative analysis of the turnover of various types of products.

EVA indicator capabilities to analyze the efficiency of working capital

When analyzing the efficiency of the enterprise in recent years in foreign and Russian practice, increasing attention is paid to the Economic Value Added Indicator - EVA (Economic Value Added).

Economic added value is a net profit of the enterprise, reduced by the amount of fee for the entire capital, invested in the organization. It is assumed that the enterprise should be not only income in principle, but also to make a profit, the maximum possible of alternative options. This explains the fact that when calculating EVA from the amount of profit, the fee for the use of not only borrowed funds, but also its own capital is deducted. In modern literature, EVA is calculated as an indicator of evaluating the effectiveness of the entire capital of enterprises (non-current and current assets). The dissertation proposed to calculate this indicator and to assess the efficiency of the use of working capital.

To make such a calculation, first of all it is necessary to exclude the impact on the profit of investments in non-current capital. For this, in the thesis, it was proposed to use in the calculations not profit from ordinary activities, and profit before the recognition of interest, taxes and depreciation (EBITDA). Next, it is necessary to determine the amount of capital attached to the revival means of the enterprise.

Subsequent analysis involves a number of assumptions:

- own capital is primarily used to create non-current assets, working capital are formed due to its remaining part;

- long-term loans are fully spent on the purchase of non-current assets. In practice, a situation is possible when, by attracting long-term loans, the company will finance investments into current assets, but it is rare enough.

Then the following ratio is true:

Own capital minus deviations in the cost of property

long term duties

Fixed assets

If the amount of non-current assets exceeds the amount of long-term liabilities, this means that working capital was financed by short-term obligations and part of their own capital. If the amount of non-current assets less than the amount of long-term liabilities, this means that part of these obligations is the source of financing of current assets and is not aimed at the formation of non-current assets of the enterprise.

Knowing the structure of capital aimed at the formation of working capital, it is possible to calculate its price. The dissertation provides for the use of the weighted average capital price (WACC), which can be calculated as follows:

Wacc \u003d Ci * di (11)

where: CI - the price of the source, taking into account the tax effect,%.

Di is the proportion of the source in the total amount of liabilities aimed at forming working capital.

Then the EVA indicator for working capital can be calculated by the formula:

EVA \u003d EBITDA - WACC * TC, (12)

where: TC (TURN CAPITAL) - the amount of working capital of the enterprise.

Depending on the obtained EVA values, the following conclusions can be made:

- EVA \u003d 0. The owner of the enterprise equally wins, continuing operations in the selected direction or investing bank deposits. The decision to develop selected areas should be made on the basis of marketing tasks (maintaining market share or care, maintaining the image and mission of the enterprise), as well as the risk of activity;

- EVA\u003e 0. The investment of working capital in the selected activity is effective, the market value of the enterprise increases, this direction should be developed;

- EVA.< 0. Рыночная стоимость предприятия уменьшается. Вложенный в оборотные средства капитал уменьшается за счет потери альтернативной доходности.

Thus, the EVA indicator complements the active toolkit of the profit analysis methodology obtained as a result of the management of working facilities, by using not only relative values \u200b\u200b(profitability), but also absolute.

LISTPublications

- Toyker D.V. Analysis of the efficiency of working capital with EVA // Herald of the University (State University of Management). - 2009. - №15 - 0.2 p.

- Toyker D.V. New view on turnover // Economist. - 2007. -№5 -0.3 P.L.

Monographs

- Modern trends in the development of accounting and economic analysis: Theory and Practice: Monograph / Ed. MA Vakhrushina. - M.: Publishing and trading corporation Dashkov and Co., 2009. - 0.5 P.L.

Other publications

- Toyker D.V. How to calculate the need for working capital // Management accounting and finance. - 2008. - №3 (15) - 0.5 pl.

- Demchenko O.A., Toyker D.V. What the budgets are eating // Boss. - 2006. - №4 -0.2 P.L.

- Toyker D.V. Liquidity Analysis: Management Aspect // Management Accounting and Finance. - 2006. - №1 (05) - 0.3 p.

- Toyker D.V. Analysis of the formation of material and industrial stocks. // Modern problems of the organization's methodology of accounting, economic analysis and audit. Materials of the Scientific and Practical Conference of the All-Russian Abovation of the Financial and Economic Institute (November 28-29, 2002). In 2 h I / ed. Prof. L.T. Gilyarovskaya - M. Modern Economics and Law, 2003. -0.1 P.L.

- Plaskova N.S., Toyker D.V. Accounting as an informational base of financial analysis. // Financial newspaper. Regional release. - 2002. - №35 (408) - 0.3 p.