Today we will talk about the paradox of frugality, which is one of the consequences of excessive saving. Modern economists have not developed a consensus on the paradox of frugality, so in this article we will try to independently understand this concept.

The paradox of thrift. Definition

The paradox of frugality was first described in the works of famous economists W. Kertching and W. Forester. This definition was developed based on an assessment of a variety of economic processes that occur in society.

What explains such a disastrous trajectory is that the spirit of the system here reinforces passion, the degree of intensity of which is excessive, rather than the support of virtue, as in "a happy illusion corresponding to prudence, it becomes the support of vice in this case of inordinate ambition" . If he were careful, the ambitious poor man could satisfy his ambition and enrich himself without falling into humiliation and bitterness, for such ambition is not a defect, nor is it necessarily promised by this fatal destiny, but is only a variety among others "These great objects of personal interest, the loss or the acquisition of which completely changes the rank of a man, are objects of passion, which are properly called ambition.”

The paradox of frugality is that if, during a crisis, people try to save as much as possible for a “rainy day,” then this day comes much faster.

The reason for this state of affairs is that with an increase in the level of savings of the population, the volume of consumption is significantly reduced. Thus, the aggregate level of demand in the state’s economy decreases, which, in turn, reduces the aggregate volume of goods sold and causes a drop in production. Due to the fall in production, the salaries of employees are reduced, making it much more difficult for them to save.

This is a passion very close to the search for the social difference of which we have already spoken above, and it is right that ambition, “as long as it remains within the framework of prudence and justice, is always admired in the world.” Like any other passion, ambition is virtuous when its intensity is moderate and approved by an impartial spectator. It is vicious only when its intensity is excessive and condemned by an impartial spectator; this is then very close to vanity. Such is the case with the ambitious poor man who calls out Smith, who may be called an upstart.

The phenomena described above have a negative impact on both producers and consumers.

The phenomena described above have a negative impact on both producers and consumers.

The paradox of frugality causes a decrease in the growth rate of the state economy, since it is high level consumption by the population is the main factor stimulating economic growth.

He decides to satisfy his ambitions by following a path that gradually leads him away from virtue: “To patronize, to receive and to enjoy the respect of the admiration of mankind are the great objects of ambition and imitation.” Two different routes are presented which also lead to this desired object: the study of wisdom and the practice of virtue, and the other the acquisition of wealth and greatness. Our emulator presents two different characters: one of proud ambition and ostentatious greed, humble modesty and fair justice.

Once the bad road is chosen, the spirit of the system weighs all its weight as a “second thought.” This highlights harmful effects negligence. The imprudence of the ambitious poor is, of course, not the general imprudence we spoke of above, which is to trade the short term for the long term. The ambitious poor man takes the long term into account, but his excessive desire for wealth causes him to misunderstand his interest on two counts.

There are many reasons why the paradox of frugality arises. The main reason is the population’s fear of losing their own cash due to crisis events. Due to any rumors about an imminent crisis, the population begins to refuse to make expensive purchases. This happens because, due to the fear of losing their jobs and being left without a livelihood, people try to accumulate as much free cash as possible.

Here, the consideration of utility does not alleviate calculation errors in relation to utility, so-called, on the contrary, it strengthens them. Indeed, beyond a certain point, wealth becomes irrelevant. It should be clear that it is expensive, and sometimes more expensive than to obtain. This generates as much, and sometimes more, pain and melancholy than pleasure and joy. This is what the ambitious poor realize at the end of their lives, and what makes it so bitter: Power and wealth, then appear as huge complex machines, consisting of the best and most delicate sources, invented to create some vain comforts for the body: Machines which must be kept in order with the most careful attention, and which, notwithstanding all our care, threaten every moment to break and crush their unfortunate owner in their fall, and they are huge buildings, the construction of which requires labor whole life threaten every moment to bury the inhabitant, and which, while they are upright, though they may protect against slight inconveniences, cannot protect him from all the cruel rigors of times. and from the rain of summer, and not from the storm of winter, and yet leave him as exposed, and sometimes even more than before, to suffering and misery, or to sickness, danger and death.

Practice shows that in order to get out of a crisis situation, the state needs to stimulate consumer demand. But the paradox of thrift forces the population to reduce their level of consumption. It turns out to be peculiar vicious circle, which does not allow the state to quickly overcome the crisis situation and resume economic growth. An increase in the level of savings of the population aggravates the crisis situation, and people, noticing that the situation in the economy is getting worse, spend even less, because they are afraid of being left without a livelihood in the future.

In other words, beyond a certain point, the desire to get rich is completely frivolous. We again find the thought that in itself, when divorced from any search for utility, the so-called spirit of the system produces only a frivolous taste for trinkets. the vices of possessing a palace are no more interesting than having a trinket: He finally begins to find that wealth and grandeur are nothing more than the trinkets of utility, the well-being of the body and the peace of mind, that small toiletries love lovers of trinkets and that they are alike on them, more difficult for the one who bears them than all the advantages they can give him are convenient.

Overcoming the paradox of frugality

Currently, there are two main methods by which the state can overcome the paradox of frugality and get out of a crisis situation. The first technique is to stimulate various sectors of the national economy with the help of government orders. As an example, we can cite the situation when in 2008 the leadership of the Russian Federation adopted a whole list of various state programs designed to stimulate domestic demand. One of these measures was the car recycling program, which simultaneously solved problems with the environment (old cars pollute the atmosphere much more than new ones), as well as with the sale of domestic cars. With the help of this program, it was possible to purchase only domestic cars, thanks to which it was possible to increase the workload of the Russian automotive industry.

One must be blinded by vanity or an excessive desire not to perceive the similarity between trinkets and great wealth: “There is no difference between them.” real difference If it is only the conveniences, some more evident than others, wealth and grandeur more effectively satisfy the love of difference, so natural to man.” Thus, a happy illusion can be transformed into severe disappointment. Frustration arises as the excess of pleasure in the spirit of the system is weakened and exhausted, as it becomes increasingly clear that the advantages of excessive wealth cannot compensate for the illusion becoming debilitating due to its cruel clash with reality, and it is realized that the game played so excessively , wasn't worth the effort.

Also this year, the Ministry of Defense placed significant orders for the purchase of KAMAZ trucks.

Thanks to the targeted programs described above, the state managed to stimulate sales of expensive automotive products.

Thanks to the targeted programs described above, the state managed to stimulate sales of expensive automotive products.

Smith adds that this exhaustion of the spirit of the system may certainly affect all men, even the virtuous, particularly in times of melancholy or illness: Greatness appears on this wretched day to anyone who suffers from melancholy or illness, comes down to a careful consideration of his own situation and to consider what is really missing from his happiness. Even without reaching a situation where the advantages of disproportionate wealth do not compensate for its disadvantages, a melancholic or sick person may tell himself that wealth does not serve him much, since this particular person cannot provide him with a pleasant state of mind.

The Paradox of Thrift

According to the classics, a high propensity to save contributes to the prosperity of a nation, since the greater the savings, the deeper the reservoir from which investments are drawn.

Keynes came to the conclusion that in countries that have reached a high level of development, the desire to save will always outstrip the desire to invest, but for the following reasons:

But, on the one hand, a virtuous person, deprived of pleasure from the spirit of the system, can remain the pleasure of moral approbation. On the other hand, the lack of pleasure in the spirit of the system is not sustainable for those who have not pushed it to excess. He who must not reproach himself with imprudence, and has not sacrificed all to excessive ambition, will soon recover the pleasure of the spirit of the system, when health returns: But if this philosophy is melancholy, familiar to every man in time of illness or debauchery, thus completely depreciates these great objects human desire, we will never cease to consider them in a more pleasant aspect once we have restored better health and the best humor. past depression, the spirit of the system can again serve as support for the prudent pursuit of wealth and the virtuous satisfaction of self-love.

1) with the growth of capital accumulation, the marginal efficiency of its functioning decreases;

2) with increasing income, the share of savings increases, since savings are an increasing function of income.

If the economy is underemployed, an increase MPS will mean a decrease MRS. A reduction in consumer spending will lead to an increase in unsold products, and production and NI will begin to decline. The multiplier effect will lead to the fact that a slight increase in savings will be expressed in a much larger decrease in income (Figure 19.5). The paradox of frugality is that society's attempt to do moresbeRegulating (which is reflected in the upward shift of the saving curve) may be futile due to a multiple decrease in equilibrium income.

Capitalism: illusion and disappointment double

Since he is guided by the spirit of the system, the desire for wealth fluctuates between happy illusion and cruel disappointment, depending on whether it follows the path of virtue or vice. no doubt stronger than in capitalism. Smith insists even more on the accumulation of capital for profit, which he sees as the main source of the process of increasing wealth in trading societies.

If capitalism is thus especially capable of satisfying the desire for wealth, it is also the place of the superiority of the illusion generated by the spirit of the system. Smith is not explicit in this view, but the perspectives opened by his analyzes seem to permit such an interpretation. Indeed, we have seen that the spirit of a system is characterized by a passion for a set of means, bracketing the end to which these means should tend. In capitalism this bracketing is stronger than in any other way of getting rich.

Thrift, while good from the individual's point of view, turns out to be evil from the social point of view due to its undesirable effects on overall output and employment.

Moreover, households have significant incentives to save more precisely at a time when increasing savings is not economically feasible, that is, when the economy enters a recession.

Accumulating capital for profit is different from accumulating wealth for consumption or even preservation, since the end may be completely lost from sight. When a person enriches himself in order to consume, or when a person saves, the object about which we're talking about, remains very much in mind: a man enriches himself or saves himself in order to be able to offer his property. On the other hand, when capital is accumulated for the purpose of making a profit from it, not only is pleasure delayed, but it is indefinitely deferred, and its object can be neglected. the idea of what profit will be made or, in a sense, the same, just having the idea of reinvesting it over and over again.

However, if we accept the assumptions of the classics that the money market effectively links decisions on savings and investments, i.e. transforms savings into investments, then the upward shift of the savings curve will correspond to the same upward shift of the investment curve, therefore the equilibrium ND will remain at the same level . Consequently, output and employment will not change, but the structure of production will include more capital goods and fewer consumer goods, leading to faster economic growth in the future.

To be honest, the consumer or screensaver can name what would give him pleasure even in very long term, but the capitalist only claims that he is looking for a good investment, without hearing anything more specific than an investment offering a high rate of return.

Thus, in capitalism there is a doubling, raising into a single whole the spirit of the system, if one can say: a person who enriches himself by consuming or storing strives to “have means,” but a person who capitalizes strives to “have means” in order to “have means.” . Moreover, thanks to this squandering of the spirit of the system, capitalism is more effective than any other way of getting rich: wealth is used to obtain wealth and only wealth. Capitalism functions as a closed circuit in which wealth reproduces itself without opening itself to enjoyment.

In addition, if the economy operates within the classical segment of the aggregate supply curve, that is, experiencing demand-pull inflation, then the desire of households to save more will move the aggregate demand curve downward and the inflation rate will decrease. Increasing savings in this case is desirable, as it helps curb inflation.

More precisely, there is a pleasure that motivates the capitalist, otherwise he will not act, but this pleasure is not the pleasure of the goods acquired by wealth, it is the free pleasure of the spirit of the system. Thanks to this gratuitous pleasure, which never burdens his accounts, the capitalist can provide an absolute and final triumph of utility over pleasure, whereas with the consumer or saver this triumph is only relative and temporary.

But if capitalism is the place of the superiority of the illusion generated by the spirit of the system, then it is to be feared that it is also the place of greatest disappointment. disappointment, he simply take, for example, the case of “upstart access to wealth through hard work is not the case” of the acquisitive capitalist. But it is not difficult to understand the double, square disappointment that capitalism can lead to.

Topic 12. Macroeconomic instability and forms of its manifestation. Economic cycle and its main characteristics.

Economic growth is a long-term trend in the development of the economy, that is, the process of a progressive increase in real GNP and income in the long term.However, the development process does not occur evenly, but cyclically.

Cyclicity is a general form of progressive development, reflecting its unevenness, the change of evolutionary and revolutionary forms of economic progress.Cyclicity as a form of economic dynamics reflects continuous oscillatory movement, alternation of ups and downs, mainly extensive and intensive types of development. But at the same time, the epicenter of cyclical development is a crisis in which the following are simultaneously revealed:

a) the fact of satisfying a certain set of needs and the impossibility of their further development based on the existing level of technology and technology;

b) impulse for further development.

Economic cycles differ from each other in duration and intensity. The following main types of cycles are distinguished.

1. Long-wavelength, repeating after about 48-50 years, known as “Kondratieff waves”. They are associated with the transition from one technological method of production to another.

2. “Construction cycles” by S. Kuznets, lasting 18-25 years, associated with the frequency of renovation of the housing stock and industrial buildings.

3. Average, or normal, lasting 8-10 years, which were studied by K. Marx and Juglar. These cycles are associated with the renewal of fixed capital and the change of generations of equipment.

4. Small cycles, or Kitchin cycles, lasting 2-3 years, associated with changes in reserves.

Among many different explanationsreasonscycles, three main approaches can be distinguished:

1) the cycle is a phenomenon external to the economic system;

2) a cycle is a phenomenon inherent in the economy;

3) the cycle is a synthesis of the internal state of the economy and external factors.

Many researchers believe that external (exogenous) factors are the producers of the initial impulses of cycles, and internal (endogenous) causes convert these impulses into phase oscillations. Keynesians name the level of aggregate expenditures among the endogenous causes, so the multiplier mechanism - the accelerator - is placed at the center of the cycle problem; Monetarists believe that cycles are caused by a shortage or excess of the money supply.

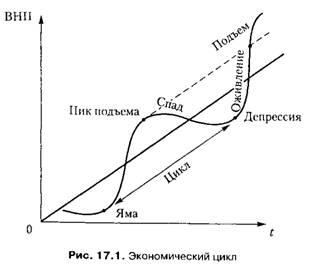

There are four phases in the economic cycle: recession, depression, recovery and recovery (Figure 17.1). These phases differ from each other in duration and intensity.

Characteristics of a recessionare liquidation of inventories, reduction in industrial investment, high unemployment, massive bankruptcies, etc. In the case where the recession is severe and prolonged, there isdepression.The lowest point of recession is characterized by the fact that production and employment, having reached their lowest level, begin to climb out of the “bottom” again.

In the revival phasethe level of production rises and employment rises up to full employment levels. The price level begins to rise until full employment occurs and production begins to operate at full capacity.

During the recovery phaseindustrial investment grows, the demand for labor increases, and the demand for credit increases. The peak of the rise is the pinnacle of business activity. The economy is running at full capacity. Investments and costs for buyers are very high. The price level tends to rise, and the growth of business activity stops. All this sets the stage for the next phase of the decline.

After the Great Depression of the 30s. XX century There have been significant changes in the global economy, which can be summarized as follows:

a) increasing the degree of monopolization;

b) transition to a post-industrial society and an innovative economy, characterized by the continuous renewal of goods, products, services, knowledge, information, etc.;

c) countercyclical government regulation.

Under the influence of these factors, a modification of the economic cycle occurred: firstly, the average cycle time was reduced from 8-12 to 5-6 years; secondly, the structure of cycles undergoes significant changes, in particular, phases are smoothed out; thirdly, the synchronicity of world cycles is disrupted, etc.