When paying accrued wages, it is necessary to fill out a payroll; this personnel document will be drawn up on the basis of the payroll. The standard form of payroll is T-53. How to fill out this form correctly? Let us dwell in more detail on the features of filling out the T-53 form. In the article, in addition to finding a completed sample form, you can also download the T-53 form itself.

Sample of filling out a payroll (form T-53)

You need to fill out two sheets of the form: on the first sheet there is general information about the organization, the payroll period and the amount that needs to be paid to employees; on the second sheet you will find a table in which you need to enter a list of employees to issue their salaries.

You can download a sample and a payroll form below, but if you have any difficulties filling it out, we will analyze in detail the design of this form.

Filling out the cover page of the payroll (T-53)

The name of the organization is indicated on the title page. If the salary is issued to a specific structural unit of the organization, then its name is indicated in the next line. If wages are paid to the enterprise as a whole, then we put a dash.

The corresponding account is the account for accounting of settlements with personnel for wages - account 70.

Next, you need to indicate the period for which funds for the payment of salaries are cashed from the current account. Cash in excess of the established limit cannot be stored at the cash desk; in the evening all cash must be deposited at the bank. The exception is funds cashed for payment of salaries; they can be stored for 3 days, including the day they are received at the bank. Therefore, in the line “to the cashier for payment from.. to..” you need to indicate a three-day period, starting from the day the money is received at the bank.

Next, indicate the total amount of wages, in words and figures; serial number of the statement and date of preparation. The month for which wages must be paid is written as the billing period.

Payment statement. Filling out Sheet No. 2

Next, you need to fill out a table in which you need to fill in the employee data indicated in the table sequentially and line by line: the employee’s personnel number, his last name and initials, the amount of salary due in figures.

If some employees have not received their salaries, for example, due to absence for three days indicated on the title page, then the money must be handed over to the bank, and in column 5 the deposit of the amount must be noted. The employee will receive it later.

When the entire table is filled out, the employees have received their earnings, under the table you need to write the total amount issued and, if any, the deposited amount. The amount is indicated in words and in numbers in brackets. In the column “paid” the last name, first name and patronymic of the person responsible for issuing the salary are indicated.

Next, the document on the basis of which money was issued to employees from the cash register is indicated; this is an expense cash order: its number and date. That's it, the payroll is completed, you need to submit it for verification to the accounting department and for signature by management.

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

Video lesson “Accounting 1C. Salary payments. Vedomosti"

The video tutorial covers step-by-step instructions for paying wages in 1C Accounting 8.3 through the organization's cash desk. The lesson is taught by Likina O., a payroll accountant at M.Video Management LLC.⇓

See in more detail the accounting of wage payments in 1C Accounting.

The preparation of payroll records accompanies the issuance of wages to employees of enterprises and organizations. The peculiarity of this document is that it is both settlement and payment, which in turn can significantly reduce the company’s document flow. It is worth noting that it is most advisable to use payroll in small businesses, but in large companies it is better to fill out payroll and payroll separately.

FILES 2 files

Who fills out the payroll form?

The payroll statement is the primary accounting document, so its preparation is the responsibility of a specialist in the accounting department. The basis for drawing up the statement is employees, which is usually maintained by the personnel officer or secretary of the organization. The document is of a regular nature and is issued once a month (before the payment of wages).

Procedure for preparing payroll statements

Before issuing wages, the responsible employee of the enterprise checks the time sheet, which is then transferred to the accounting department. Next, the accountant enters the necessary data on the title page and in the table, signs the statement himself and sends it to the head of the company for approval, then passes it to the cashier.

The payroll statement is stored in the archive, like all documents of the enterprise.

After the money is issued, the statement is returned back to the accounting department, where, after the chief accountant checks the information entered into it, information about it is entered into a special internal journal of documents, and the statement itself is sent to the archive of the enterprise.

When is Payroll Used?

The statement form is filled out in cases where wages are transferred through the cash desk of the enterprise by issuing cash to employees.

In cases of transfers to bank accounts and employee cards, other documents are used.

Rules for compiling and processing payroll statements

Today, the statement can be drawn up in free form or according to a template developed within the enterprise (in this case, the document must be registered in the company’s accounting policies). Many enterprises, in the old fashioned way, prefer to use the previously mandatory T-49 form. This is due to the fact that this form includes all the necessary information and has a convenient and understandable structure.

You can fill out the document either in handwritten or printed form (the second option significantly speeds up the process), and regardless of which path is chosen, the form must contain the original signatures:

- responsible employees,

- head of the company,

- as well as the employees of the enterprise who received money from it.

What to do if there are errors in the document

You should be extremely careful and scrupulous in filling out this document, checking and double-checking all the information entered into it. You should try to avoid inaccuracies and errors, but if they do happen, and for some reason it is no longer possible to redo the entire document, you need to carefully cross out the incorrect data and write the correct data on top. In this case, next to the correction you should write “believe the corrected”, and next to it should put the signatures of all the employees responsible for compiling the statement.

It is important to note that using a bar corrector to correct errors is unacceptable.

An example of preparing a payroll statement

The first part of the document includes basic information about the organization:

- Its name,

- name of the structural unit or department for which salaries are calculated (if any),

- company code according to (All-Russian Classifier of Enterprises and Organizations),

- date of filling out the statement and document number for internal document flow.

- the amount of money issued from the cash register in the form of wages,

- date of issue,

- the period for which it is issued (here you need to indicate its start and end date).

Finally, this part of the document must be signed by the top persons of the company: the manager (or an employee authorized to act on his behalf), as well as the chief accountant.

Below is the main part of the document, which is formatted as a table.

At first column, the employee number is entered in order,

in the second– his (located in the personal card),

in third- position (in accordance with the staffing table).

In the fourth indicates the method by which the employee works (or).

From fifth to seventh- the number of days he worked (strictly based on the data reflected in the time sheet).

If necessary, in the table you need to note the number of weekends and holidays on which the person also went to work (for which double wages are paid) or put dashes here.

The following columns are devoted directly to the calculated amount of wages.

Eighth The column records how much is accrued to the employee in accordance with the tariff rate. Ninth the amount of the bonus is indicated (but only if there is a special order or order from the director of the company).

To the tenth data on sick leave payments is entered in the column,

from 11 to 13– all other amounts. If some types of accruals are missing, dashes must be placed in the required cells.

In the fourteenth The column should indicate the total amount charged.

Next to the table on the fifteenth you need to enter information about the income tax that is withheld from the employee (in the amount of 13% of the total amount of income),

into columns from 16 to 18– all other types of deductions (advances, penalties, etc.).

Add to column at number 19 the debt (if any) attributed to the enterprise in relation to the employee is entered,

A at 21 The final amount to be issued is entered in the column. Its value is calculated simply: from the sum of all charges (column 14), the amount of deduction (column 15-18) is subtracted and the amount of debt is added (column 19).

Finally, the employee for whom the information was entered must sign opposite each line.

After the table of the document is completely filled out, the entire amount of money that is issued to employees in the form of wages is indicated below in words. Then the statement is signed by the cashier and the accountant of the enterprise.

The calculation of wages to employees can be reflected both in a document that is also intended to record the payment of wages, and in a separate document - a payslip. We will tell you about the features of using and filling out the pay slip (form No. T-51).

Payroll: what is it used for?

The payroll is used to calculate wages for the organization's employees (including advance payments - wages for the first half of the month).

An organization can use both an independently developed payroll form and form No. T-51, approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Let us describe some of the features of compiling a payroll using the example of form No. T-51.

Payroll (form No. T-51): features of preparation

If an organization uses a payroll (for example, according to form No. T-49), a separate payroll is no longer compiled.

The payroll is filled out for all employees, regardless of how they receive their wages (in cash or by transfer to bank cards).

Payroll T-51 is compiled by the accounting department in one copy.

The calculation of wages in the payroll is carried out on the basis of data from primary documents recording production, hours actually worked and other documents.

In the “Accrued” columns, amounts are entered by type of payment from the wage fund, as well as other income in the form of various social and material benefits.

At the same time, all deductions from the salary amount are calculated and the amount to be paid to the employee is determined.

In pay slips compiled on a computer, the composition of the details and their location are determined depending on the adopted information processing technology. In this case, the document form must contain all the details of the unified form.

Payroll T-51: download form

You can find the pay slip (form No. T-51) by referring to the Resolution of the State Statistics Committee of the Russian Federation dated 01/05/2004 No. 1, or by code T-51 in the reference and legal system “ConsultantPlus”.

There are standardized forms of documents that are prescribed to be used when making cash payments. These include the payroll for the payment of salaries, approved by the State Statistics Committee back in 2004, but still in force. The T-53 form code and its sample are in the albums of unified salary forms.

The salary slip can be made on different forms. Usually, those that are most convenient and easy to fill out are chosen. Despite the large number of standard forms, many experienced accountants still prefer this solution, since the payroll form T 53 allows you to record payments to a large number of employees at once. This functionality significantly reduces the number of papers and the time to fill them out.

Download payslip for payroll

A unified salary slip form can be downloaded online on the Internet. Finding the right document will not be difficult, as it is in great demand. The main thing is not just to find the right form, but to fill it out correctly. Let's take a closer look at what each form sheet consists of, what needs to be written and where. We will have a kind of applied instructions for filling out T-53, which will be especially relevant for beginners in accounting.

Salary payment slip form 1 page

On the 1st sheet of the form, the accountant enters:

- Name of the organization indicating its organizational and legal form, for example, Three Keys LLC

- The name of the structural unit - this could be: accounting, administration, workshop, canteen, etc.; OKPO company code

- Corresponding account is an accounting register for attributing costs, it can be 20, 26, 44 or another collection and distribution account

The title page of the form is endorsed by the chief accountant and the head of the company, the transcript of their signatures and the date when the responsible persons familiarized themselves with the document are indicated.

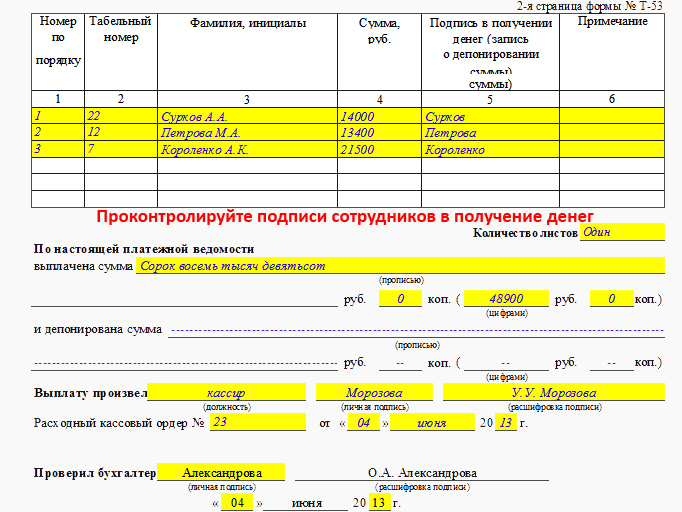

Payroll form T 53 sample filling page 2

Page No. 2 of the form includes a list of employees, indications of their personnel numbers, amounts to be issued and contains signatures about the receipt of money by employees. If the salary has not been issued, it is deposited and a record is made of this in the specified form.

If there are a large number of employees, the accountant may need several sheets No. 2 of the salary slip. All of them are made similar to the form given above and filled out in the same way. At the end, the accountant is obliged to summarize the payment of wages as follows:

The total number of sheets of the fully completed statement must be indicated, the amounts must be entered in numbers and in words:

- wages paid

- deposited wages

The persons who issued the money and those who checked the results of the operation with their signatures and transcripts are indicated. The number and date of the cash receipt order according to which money for wages was taken from the cash register must be written down.

A fully completed one-page sample payroll slip looks like this.

As you know, today there are various forms of remuneration for employees in an enterprise. Depending on the form of payment, as well as its component, certain documents are used for accounting.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call by phone.

It's fast and free!

In general, the most common forms of salary today are:

- Salary.

- No salary.

- Salary + % of sales.

- Commission based system.

- Tariff and non-tariff.

Under the tariff system, the employee is entitled to additional payments depending on working conditions (hard, harmful, etc.). Moreover, such additional payment is established by legal acts, the list of which is presented in the Labor Code.

Cover part is established by the employer, is prescribed in the employment contract and is unchanged in accordance with the employment contract.

Without salary form of payment represents payments based only on the work performed, that is, a kind of piecework payment. This form of payment is calculated based on employee reports, completed work orders, and so on.

Salary form +% of sales, the most common form of calculation, here you will need a sales report from both the employee himself and the head of the department, if there is one.

What is a payroll and in what cases is it used?

The payroll reflects all salary accruals for the company's employees. Is an accounting document. Depending on the company structure, the payroll may consist of:

- One piece, which reflects data on salary accruals for all employees of the enterprise.

- Several parts. Here payments are divided depending on the divisions and departments of the company.

A payroll is necessary for accounting accurate calculations for each of the company's employees and for accounting for wages. The statement includes complete information on the period worked, that is, working hours are calculated, vacations, sick leave and lateness are taken into account.

There are several forms for correct calculation:

- Payroll sheet T-49. This form of payroll is used for primary reporting. Here, 23 columns are taken into account, where all calculated salary accruals are described in detail. When filling out Form T-49, no other forms are required to fill out. This document contains general accruals and deductions, thanks to which the overall result is displayed.

- Payroll T-51. Figuratively speaking, this form is used for non-cash wage payments. It is drawn up exclusively in a single copy and filled out by an accountant.

- Payroll number T-53. It is used for issuing wages and is declared by employees with signature. Compiled on the basis of the T-51 form. The document consists of the employee’s personal data, namely:

- exact amount paid.

Filling rules

Filling out a payslip is a very responsible matter. It requires a lot of attention.

After filling out the statement, you must register it in the journal. This magazine changes once a year:

- So, on the first sheet you need to indicate first name, last name and patronymic of the employee or name of the company.

- The next column is dedicated to company classification code and corresponding account number.

- The date the statement was completed is indicated.

- Then the full amount is written down issued funds, both digitally and in words.

- At the end of the first sheet it is written date of the billing period.

- Next, the statement is certified by the manager.

- Then the actual issuance of the salary and the filling out of the statement takes place. That is:

- The employee's full name is entered.

- On the contrary, the amount issued is written down.

- And in the last column is the employee’s signature on receipt of funds.

- After the whole process it is necessary submit the statement to the chief accountant for verification.

- The statement is closed.

- The full name of the company is written on the title page of the document, as well as the organization code, statement number and date of completion.

- The tabular part of the statement includes personal data of employees– Full name, serial and personnel number of the employee and his position, as well as the number of hours worked, the amount of payments for each employee. The amount of funds withheld, if any, is also indicated here.

Correction in payroll

Of course, it is best not to correct anything in accounting documents; firstly, from an aesthetic point of view, it looks ugly, and secondly, corrections entail certain difficulties.

However, the human factor does not always play into the hands, especially since such typos are often not made intentionally, so you should do this:

- Carefully cross out one fragment to be corrected with a straight line.

- Write the correct option next to or above.

- All persons who signed the statement before the correction must repeat this procedure to certify the new inscription.

- Insert a date for correction.

Closing payroll

Closing of the payroll occurs within the period indicated on the title page. However, not all workers can receive wages by that time. In this case, the accountant needs to do the following:

- Near the employee's name, who has not received wages, the inscription “Deposited” is placed.

- Below from the tabular part of the statement, the total amount issued and the total deposited are calculated and indicated.

- Cashier/accountant or the manager confirms the statement with his signature.

- Next, an expense order is issued, where the amount issued is indicated. The order number is entered in the corresponding column of the statement.

- Next, the statement is sent to the accounting archive for storage.

It is worth considering that the payroll is subject to tax audit, therefore, both when filling out and when closing, you should pay special attention to this document.

Storage and accounting

As you know, many accounting documents are stored in the company’s archives for a long time. Thus, the payroll is retained for 5 years, if a reporting audit is carried out during this period. Otherwise, the document is preserved for 75 years.

Accounting for wage payments is carried out on the basis of Form B-8. The payroll takes into account various increases, bonuses, deductions, as well as other payments provided for by the Labor Code of the Russian Federation.

There is also an important point to consider. If, after 3 days from the date of payment, the employee does not receive a salary, then the data is entered in the deposit column and transferred to the next month’s statement.

It should also be noted that in recent years, the accounting software that has appeared has been significantly modernized. And in the context of this topic. Namely, all accrual processes occur automatically.

Responsible persons

The responsible persons for the payroll are the chief accountant and the owner of the company. That is, the accountant is responsible for all additional payments, as well as deductions from wages. Moreover, if the document does not bear the signature of the chief accountant, the documents are invalid.

The cashier, if one is on the company’s staff, is responsible for receiving, storing, as well as issuing and accounting for funds. If there is no cashier at the enterprise, his duties are performed by an accountant.

According to the legislation of the Russian Federation, withholding wages for more than the period specified in the Labor Code of the Russian Federation threatens with criminal, material or administrative liability. Therefore, if the accountant is absent from the workplace due to illness or vacation on the day the salary is issued, the manager is obliged to appoint a deputy accountant.

Payment of wages according to the statement

As a rule, employees receive wages twice a month. And most often it is the 15th and 30th of each month. Since financial procedures are always very responsible, the company allocates a special place for issuing POs. This is either a cash register or the offices of an accountant or manager.

When receiving funds, a company employee must recalculate the amount and sign that he has received the appropriate amount, which will mean that he agrees with the amount received and has no complaints.

The payroll is prepared by the cashier, accountant or manager. If an employee was unable to receive a salary due to illness, business trip, or other reasons, then “Deposited” is written opposite his last name directly on the statement.

After the payment of wages to employees is completed, the responsible person draws up an expense order. The account number is recorded in the statement.

Paying salaries using bank cards

In accordance with the resolution of the State Statistics Committee, if a company pays wages by bank transfer, that is, on a card, then only a payslip under number T-51 is drawn up in electronic form. In this case, it must indicate all the necessary details:

- Employee's full name.

- Job title.

- Tariff rate.

- Personnel Number.

- Amount of time worked.